- Bitcoin’s performance over the last year showcased a complex journey of institutional involvement and market dynamics.

- The interplay of institutional interest, futures markets, and miner dynamics shapes Bitcoin’s year-long performance narrative.

Amidst the tumultuous waves experienced by Bitcoin [BTC] recently, it’s imperative to delve into a comprehensive evaluation of BTC’s performance over the past year, which unravels a multifaceted journey for the flagship cryptocurrency.

Read Bitcoin’s Price Prediction 2023-2024

Examining BTC’s trajectory

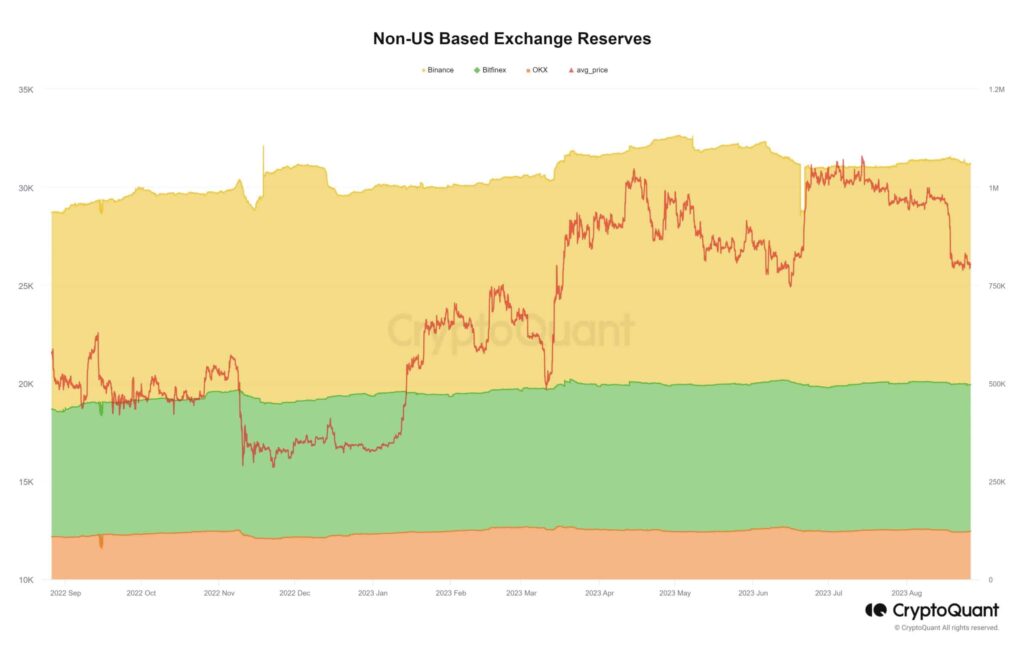

According to recent data from CryptoQuant, a notable trend emerged for BTC on Centralized Exchanges (CEXes). Bitcoin’s reserves on non-US CEXes, including heavyweight platforms like Binance, OKX, and Bitfinex, underwent a massive uptick of over 10% throughout this temporal span.

Source: Crypto Quant

Conversely, their counterparts on US-based exchanges such as Coinbase, Gemini, and Kraken encountered a significant dip in their Bitcoin reserves. This spanned a range from a 30% decrease to even more substantial drops of up to 50% or beyond.

This flux in exchange reserves carries a dual impact, influencing the supply dynamics of Bitcoin while simultaneously shaping overall market sentiment.

The institutional narrative remains a pivotal focus

An intriguing facet in Bitcoin’s narrative was the steady accumulation of Bitcoin by institutional players. This was further evidenced by an analysis of withdrawal and deposit records, which highlighted the consistent appetite of institutions for acquiring Bitcoin.

An illustrative example unfolded with Gemini, where a substantial outflow exceeding 20,000 BTC was observed. This represented roughly a quarter of its holdings according to CryptoQuants data.

Source: CryptoQuant

Furthering this trend, a substantial 27,700 BTC was moved from the wallet address ‘3Fup’ on the Gemini exchange. Subsequently, these Bitcoin holdings were disbursed to addresses like ‘1QB,’ ‘1Et,’ and ’35g.’

At press time, there was an interesting update from Glassnode. Recent data from Glassnode showcased that a large number of addresses were holding 1,000 or more BTC. This resulted in the number of addresses reaching a one-month high of 2,020. This was another indicator of growing interest in Bitcoin amongst larger holders.

📈 #Bitcoin $BTC Number of Addresses Holding 1k+ Coins just reached a 1-month high of 2,020

View metric:https://t.co/cjV0krRVgK pic.twitter.com/BN1Bes168K

— glassnode alerts (@glassnodealerts) August 27, 2023

The implications of heightened institutional participation in the intricate ebb and flow of Bitcoin’s pricing mechanics will only be revealed after some time has passed. Even though short-term whale interest may aid the price of BTC in the short term, it could leave retail investors more vulnerable in the future.

The interest from whales could also be attributed to the recent hype around Bitcoin ETF applications sent by major funds and institutions.

Analyzing the state of the futures market

Over the course of last year, market participants displayed a heightened affinity towards derivative products, underscored by Bitcoin’s Open Interest attaining new summits which reached an all-time high since November 2022.

However, in August 2023, a significant event occurred in the world of Bitcoin. There was a considerable drop in its price due to a large number of people selling their Bitcoin holdings. This situation resembled a similar occurrence that took place after the FTX incident in November 2022.

Source: CryptoQuant

Furthermore, the put-to-call ratio experienced a fractional reduction, moving from 0.48 to 0.46 over recent days, thereby signifying an evolving market sentiment. Despite the reduction of BTC’s price, the declining put-to-call ratio indicated a growing bullish sentiment among investors.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Additionally, there was a spike in Implied Volatility observed for the last few days. A spike in implied volatility for Bitcoin indicates that the market expects larger price swings in the near future. Traders anticipate more significant price fluctuations, reflecting increased uncertainty or potential upcoming events impacting Bitcoin’s value.

Source: The Block

Within this dynamic landscape, a discernible downward trend unfolded in miner revenue. The plummeting miner revenue could heighten selling pressure on miners and impact BTC’s price negatively.

Source: Blockchain.com