- BTC recorded its highest daily active address count on 2 August.

- The recent increase in network activity, surge in loss-making transactions, and growing negative sentiment are all indicators of a short-term price rally for Bitcoin.

The number of daily active addresses that trade Bitcoin [BTC] has surged in August, reaching a three-month high of 1.07 million on 2 August, data from Santiment showed. Still growing, the number of addresses that have completed BTC transactions today was 1.03 million.

📈 #Bitcoin‘s address activity has surged to its highest level in 3.5 months in August. This utility increase, combined with major loss transactions & negative sentiment, is a strong sign that a short-term (at minimum) $BTC price bounce is more probable. https://t.co/5PzjYROX5T pic.twitter.com/G2tevAWdSM

— Santiment (@santimentfeed) August 3, 2023

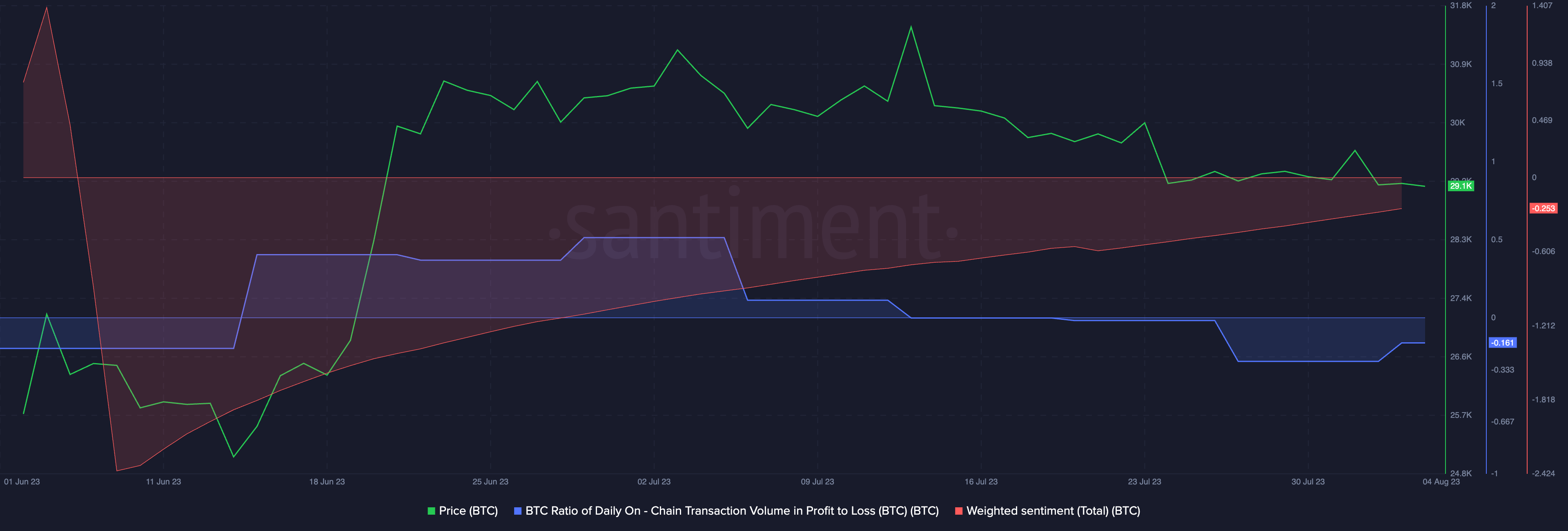

As the number of daily active BTC addresses increases, the number of transactions involving the cryptocurrency that has resulted in losses has also grown. An examination of the coin’s ratio of daily on-chain transaction volume in profit to loss revealed this.

This indicator measures the value of an asset’s transactions that return profits to the value of its transactions resulting in a loss within a single day. When the indicator logs an uptick and is above the zero line, market participants are making more profits than losses. Conversely, market participants are recording more losses when this metric returns a value below zero.

BTC’s ratio of daily on-chain transaction volume in profit to loss was -0.161 at press time, suggesting that more BTC trades returned losses at the time of writing.

Further, weighted sentiment remains negative as the coin continues to linger in a narrow price range. Per Santiment, BTC’s weighted sentiment was -0.25 at press time.

According to Santiment:

“This utility increase, combined with major loss transactions & negative sentiment, is a strong sign that a short-term (at minimum) $BTC price bounce is more probable.”

But is the king coin ready for such a leap?

Finally, a reason to smile?

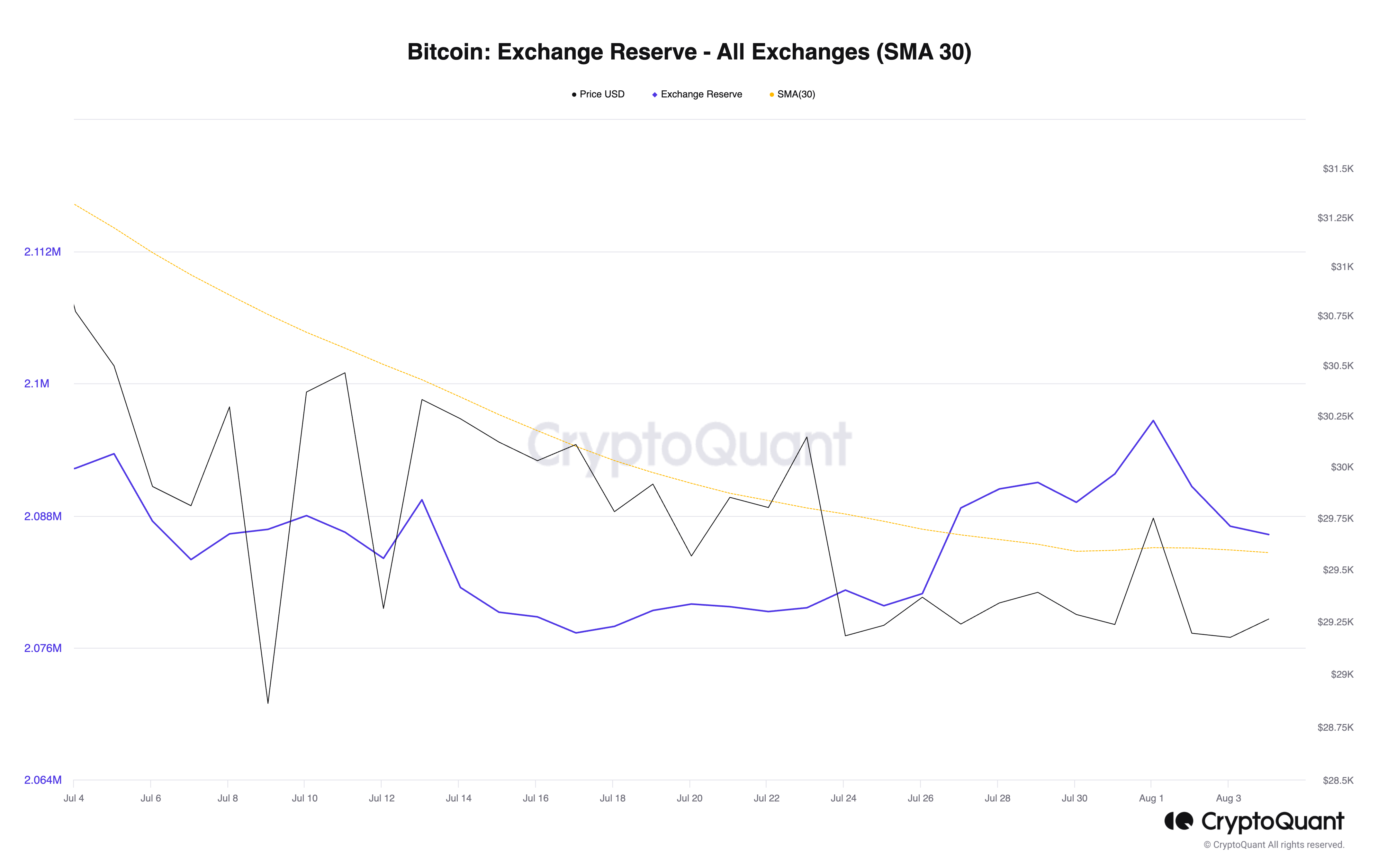

Despite facing strong resistance at $30,000 and trading in a tight range for the past two months, BTC holders have been reluctant to sell their coins, according to an analysis of exchange activity.

A look at its exchange reserves on a 30-day moving average revealed a 1.4% decline in the last month. This metric tracks the total number of BTCs held within cryptocurrency exchanges.

When the value of BTC’s exchange reserves rises, it indicates higher selling pressure as more coins are being forwarded to exchanges for onward sales. On the other hand, a decline suggests a reduction in BTC distribution and is often a precursor to a price uptick.

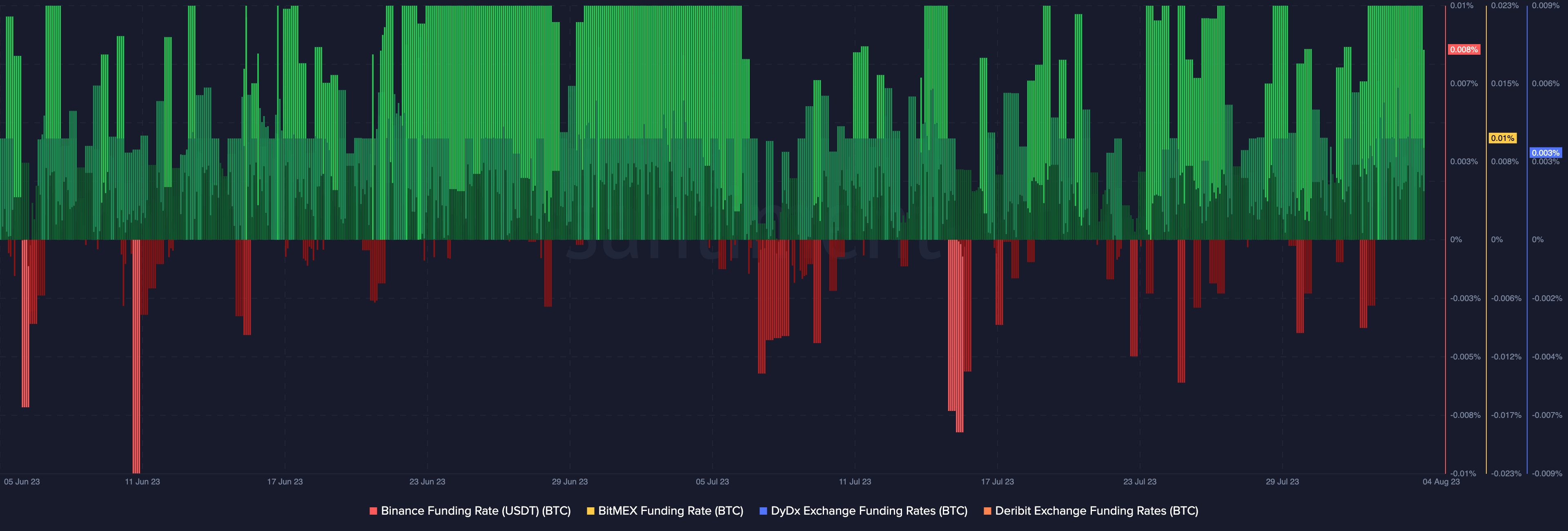

In addition the declining number of BTC sell-offs, most traders are betting on a price increase.. This is evident from the funding rates on the futures market across leading exchanges, which show that longs outnumber shorts. This is a positive sign, as it suggests that many traders believe that the price of Bitcoin will rise in the short term.

While these on-chain indicators hint at a price growth in the short-term, it remains important to pay attention to macro factors that might affect BTC’s price negatively.