Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- BTC struggled to post strong recovery from the range-low

- Long-term holders accumulated more during latest price consolidation

Bitcoin [BTC] was at a crossroads as the bears and bulls fought for the $30k price level. Since Wednesday (19 July), BTC has closed its daily candlestick sessions below $30k. The trend reinforced bears’ increasing leverage as they sought to flip $30k to resistance.

Is your portfolio green? Check out the BTC Profit Calculator

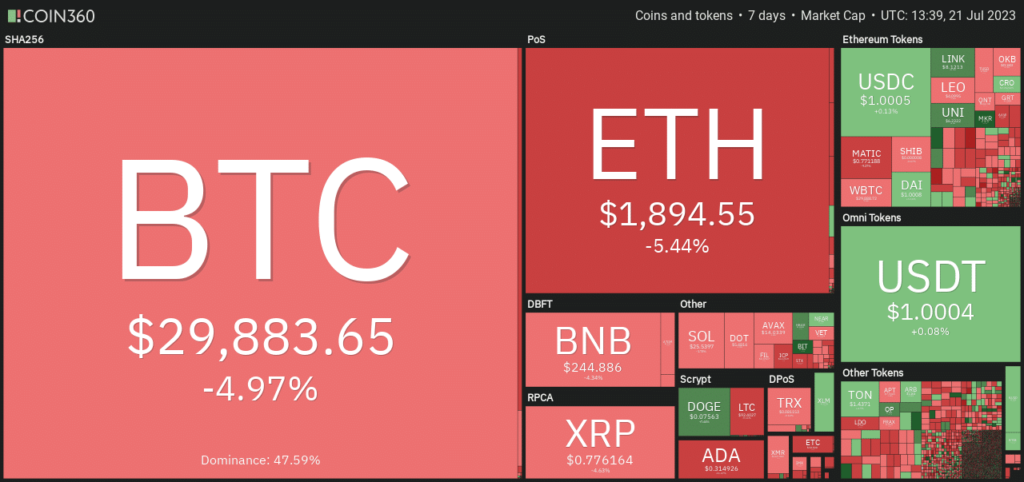

Source: Coin360 (BTC weekly price performance)

Over the same period, the US Dollar Index (DXY) edged higher, taking the opposite direction to BTC’s price action. Based on weekly performance, BTC suffered about 5% losses.

Will the range-low hold rescue bulls again?

Source: BTC/USDT on TradingView

So far, the $29.5k-level has been a crucial rebound level whenever BTC fell below $30k during recent fluctuations. Besides, the 50-EMA (Exponential Moving Average) has been a crucial dynamic support and resistance level.

So, a drop below $29.5k and subsequent breach of the 50-EMA of $29.3k will cement bears’ leverage in the market. In such a bearish scenario, the crucial support levels to watch are $28k and $26.6k, especially if next week’s (25/26 July) FOMC meeting takes a hawkish stance and unnerves investors.

Conversely, bulls could reinforce their position if they secure the range-low area of $29.3k – $29.5k. However, the $31.5k and $32k levels remain the immediate hurdles to clear before BTC stretches for $34k.

Meanwhile, the RSI (Relative Strength Index) retreated from the overbought zone and crossed the 50-mark, at the time of writing. Similarly, the CMF (Chaikin Money Flow) breached below zero. Taken together, the indicators underscored increasing bears’ leverage.

Long-term holders not worried

Source: Glassnode

Despite bearish overtures, long-term BTC holders accumulated even during latest price fluctuations. Notably, the Total Supply Held by Long-Term Holders graced a new high of 14.5 million, despite BTC threatening to record a bearish breakout.

How much are 1,10,100 BTC worth today?

Nevertheless, BTC noted over $14 million in total liquidations in the last 24 hours. Out of the $14 million, $12 million accounted for wrecked long positions, further emphasizing the strong bearish grip.

Investors should track next week’s Fed rate hike decision to confirm whether the bearish pressure will fall or not.