- BTC accumulation has persisted with over 27,000 per month.

- BTC price was on an uptrend, but MACD showed a bearish divergence.

Recent data revealed that despite Bitcoin [BTC] reaching its current price, the enthusiasm for accumulating it has remained strong. Moreover, as the number of coins being accumulated continued to grow, there was a noticeable decrease in distributions. This indicated a significant surge in hodling behavior.

Read Bitcoin (BTC) Price Prediction 2023-24

Bitcoin accumulation persists

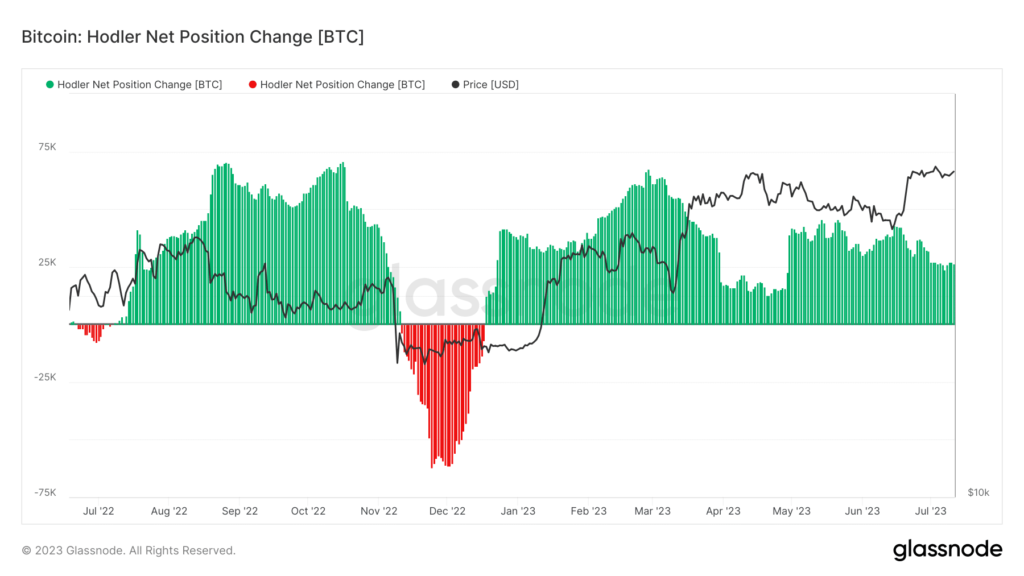

Glassnode’s analysis of the Bitcoin Hodler Net Position Change clearly showed holders engaging in a vigorous accumulation spree. Examining the chart, it became evident that by the end of December, the distribution of BTC came to a halt, and accumulation took precedence.

This accumulation trend grew stronger around February, albeit with a subsequent decline. However, even in the face of this decline, one thing remained undeniable: accumulation persisted.

Source: Glassnode

As of this writing, holders are firmly entrenched in an accumulation regime, steadfastly absorbing an impressive monthly rate of over 27,000 BTC. The chart also revealed that holders have accumulated across various price ranges, defying market trends. This behavior has persisted, even as Bitcoin experiences an upward trajectory, further highlighting the unwavering commitment of holders to accumulate this digital asset.

2-year last active BTC ramps up

Glassnode’s analysis revealed that a growing portion of Bitcoin supply is inactive, indicating a notable lack of on-chain movement. The supply last active chart, which monitors BTC that were last active between one year and five years ago, demonstrated an increasing number of coins joining this category.

Source: Glassnode

Notably, the over-two-year last active chart exhibited a more substantial addition of coins. As of this writing, this specific chart accounted for over 55.6% of the supply, highlighting a clear and persistent trend. The only age band surpassing this percentage was the one-year-plus chart. It sat at over 69%, indicating a higher concentration of long-inactive coins.

Supply in profit overshadows supply in loss

The ongoing price trend seemed to be favoring the majority of holders, as indicated by the supply in profit chart. As of this, out of the approximately 19 million BTC in circulation, with a total supply cap of 20 million, over 15 million were currently yielding profits, while around 4 million remained in a state of loss. Notably, the chart highlighted that the upward trajectory in profit began in January.

Source: Glassnode

It’s worth noting that the supply in profit and loss are inversely correlated, as each Bitcoin must fall into one of these categories.

Is your portfolio green? Check out the Bitcoin Profit Calculator

These supply regions are subject to change as spot prices fluctuate, surpassing or dropping below the price stamp associated with each Unspent Transaction Output (UTXO) in the UTXO set.

As of this writing, Bitcoin (BTC) was trading at approximately $30,800, exhibiting a marginal daily increase of less than 1%. While the price chart displayed an overall upward trend, the Moving Average Convergence Divergence (MACD) indicated a bearish divergence at the time of observation.