Ever since Ordinals burst onto the scene in January 2023, collectors have been chasing the latest trends and innovations happening on Bitcoin. Many Ethereum and Solana NFT collectors have shown interest in Ordinals but are often left confused by foreign concepts such as teleburning, cursed inscriptions, and rare sats.

This article breaks down the most important trends in the Ordinals ecosystem so newcomers can better understand the Ordinals market.

10. Teleburning

Teleburning is the act of teleporting an NFT to Bitcoin from another chain by burning it on the origin chain and then inscribing it onto Bitcoin. Only the on-chain owner of an NFT can teleburn it, and the act does not require the permission of the artist or founder. That said, in certain cases, the official project may take the stance that teleburning does not constitute an official transfer of the token. Thus all utility and IP rights associated with owning the teleburned token would be voided.

A teleburned NFT leverages a largely untested form of on-chain provenance where the original token technically sits in a wallet that nobody will ever be able to access on the origin chain. Then a smart contract on the origin chain provides an on-chain pointer to the new inscription on Bitcoin, where the “ownership” is transferred to.

Recently, the Bitcoin Bandits Ordinal community pooled together funds to purchase CryptoPunk #8611 on Ethereum and then teleburned it to Bitcoin. They have now fractionalized it and plan to send the teleburned punk to Satoshi’s wallet.

9. File Type

Ordinals is an abstract protocol that supports far more than just JPEGs. You can inscribe any file type fully on-chain onto Bitcoin. People have inscribed songs, videos, games, books, and much more.

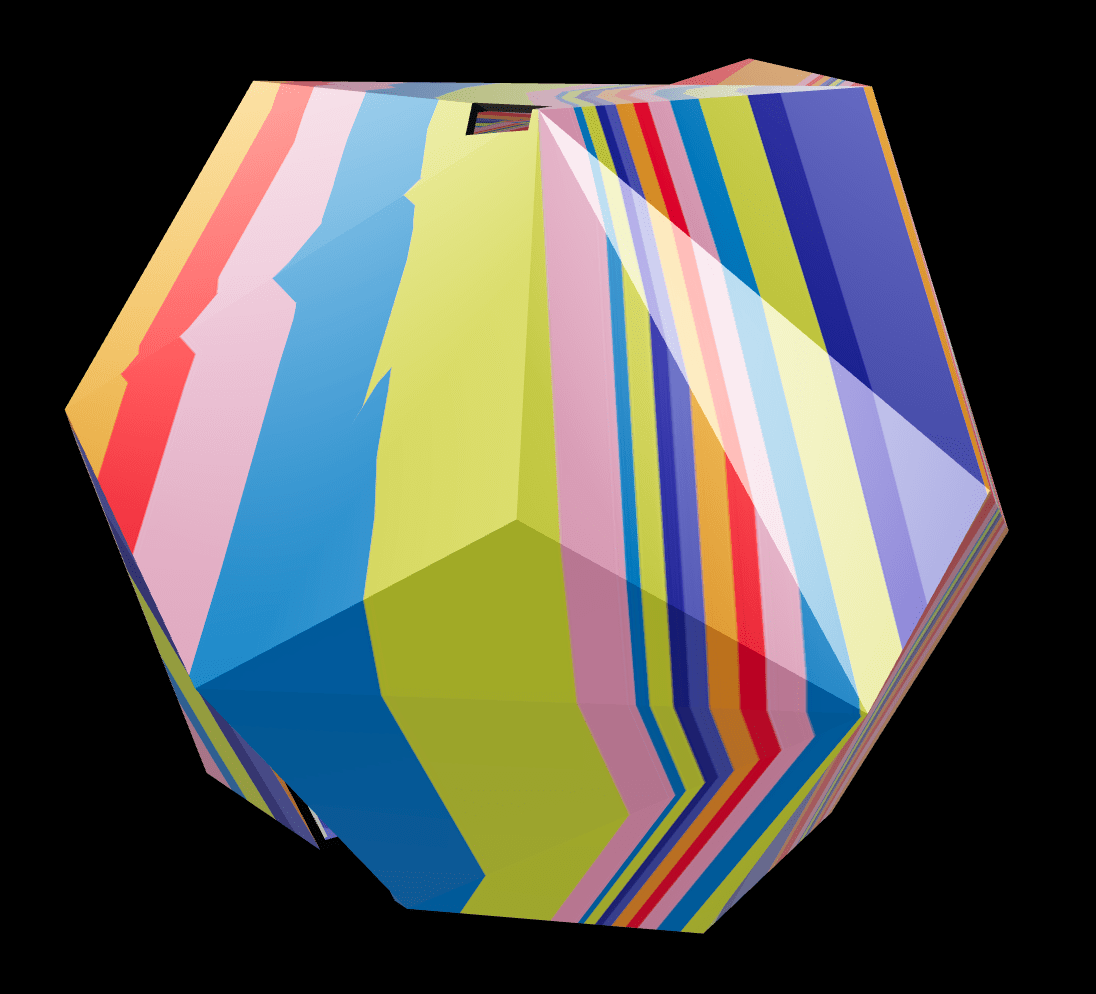

A particularly interesting example is a 3D file inscribed but the artist FAR. The file is a 3D rendering of a building that FAR designed, which can be viewed interactively in explorers and can even be projected into the real world with augmented reality on your iPhone.

There has also been excitement recently about music NFTs coming to Bitcoin. Artists and creators experimenting with unique file types are definitely worth paying attention to.

8. Domain Names

Similar to decentralized DNS systems on other chains like .eth and .sol, Bitcoin also has protocols for domain names. On Bitcoin, things are a bit different, though. Domains are free to claim, there are no renewal fees, and all TLDs are fair game. The first domain inscriptions were done through the SNS protocol under the .sats TLD, and now people have expanded to inscribing on hundreds of different TLDs.

The main rule is that to claim a domain, you have to be the first one to inscribe it. So, for example, if you inscribed test.sats but someone had already inscribed it, your inscription would be an invalid domain name. Ordinals marketplaces such as UniSat, Magic Eden, and Ordinals Wallet have already integrated with these protocols, which is a great start. Still, it is yet to be seen whether they will reach mass adoption on Bitcoin.

7. Cursed Inscriptions

The Ordinals protocol specifies that for an inscription to be valid, it must meet a certain set of criteria. There have been many inscriptions over the past several months that did something unique, which caused them to not be valid.

The Ordinals protocol underwent an upgrade in May, which indexes all invalid inscriptions as “Cursed” by assigning them a negative inscription number. This alleviated many people’s concerns by bringing the invalid inscriptions into the fold in a way that does not disrupt the order of the existing positive inscription numbers, which have become important to certain collectors.

6. Parent Child

The Ordinals Protocol will soon get an upgrade which will enable on-chain provenance for collections. The way this will work is every collection will have a “parent” inscription that all of the “children” inscriptions will point to. Which inscriptions are in what collection is currently a process coordinated between artists, marketplaces, and explorers off-chain.

What is interesting about this upgrade is that it will introduce potentially interesting ways to think about a collection. What if a very coveted <100 inscription was used as the parent for a collection? What if a collection consisted of children, multiple parents, and a grandparent? It is unclear exactly how creators will leverage the upgrade, but there will certainly be interesting experiments that you should pay attention to.

5. File Size

The size of a file is proportionate to the cost of inscribing it. The larger the file, the more fees you will have to pay to the Bitcoin network to “host” it. Bitcoin has a limit of 4 MB of data per block, meaning that a single inscription’s theoretical max size is 4 MB.

Inscribing over 400 KB requires working with a miner, which is a very costly and technical process, so 400 KB is the practical limit for most inscribers. In fact, out of over 14 million inscriptions, only four have been greater than 400 KB, and all of them have attempted to get to as close to 4 MB as possible. These are commonly referred to as “4 meggers” by Ordinals collectors.

The most notable 4 megger is inscription 652, which was created by the Taproot Wizards collection in collaboration with Luxor Mining. It was mined in block 774,628, which at the time was the largest Bitcoin block ever mined.

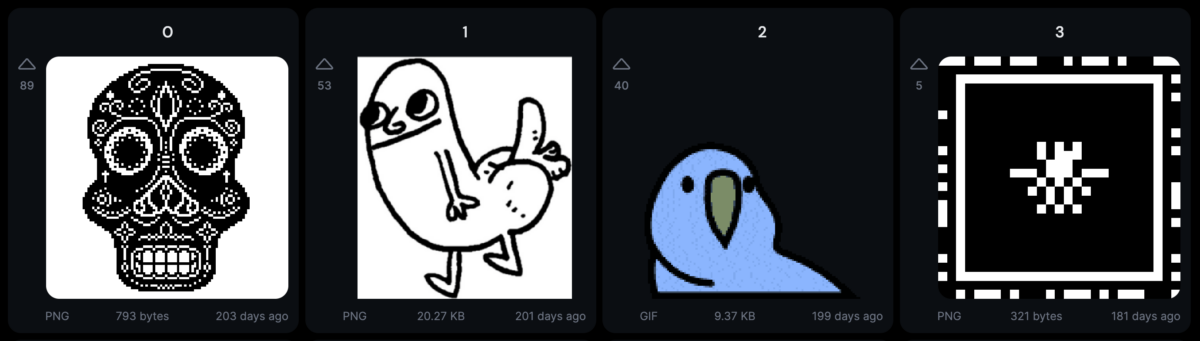

On the other end of the spectrum, certain artists strive to create as tiny files as possible. They work within the constraints of their medium to create sub-1 KB pixel art and SVG pieces. Artists and projects taking the time to understand the protocol they are working with to the degree that it informs the art they create are probably worth paying attention to.

4. Inscription Numbers

The Ordinals Protocol is unique from other NFT standards in that it is fully on-chain. Artists must pay a fee for every file they store on Bitcoin. Because of this, the number of inscriptions is very low compared to other chains. For example, on Ethereum, an artist could write a smart contract that programmatically generates one billion NFTs for a few hundred dollars. On Bitcoin, people have paid over $50 million in fees just to make 14 million inscriptions.

This leads to people thinking about inscriptions very differently from NFTs. Subconsciously, it feels more like an actual digital object because there is an actual on-chain file that backs it up. You could even think of the Ordinals Protocol as one giant 1/1 protocol.

Inscription Numbers come into play because every inscription is assigned a number based on the order it was inscribed in. For example, the first inscription was zero, the second inscription was one, and so on. This numbering system adds a layer of collectibility that is interesting to certain people. Not only are low or special numbers inherently collectible, but these numbers also convey age and time.

Collectors have organically formed clubs around low inscription numbers which can be thought of as unofficial collections. There is a <100 Club, <1K Club, <10K Club, and even <100K Club. Despite having a mixture of many types of inscriptions in them, these clubs each maintain their own floor price. Even if someone inscribed a text file of the word “hi” in the first 100 inscriptions, it would be worth several BTC today. Without understanding inscription numbers, the Ordinals market won’t make any sense. Inscription numbers can be the difference between a fart MP3 selling for 1 BTC or 0.0001 BTC.

Lastly, it’s important to note that you will hear many collections referring to themselves as <100K or <1 million. This is a badge of honor that they wear which signifies that they were early to Ordinals and didn’t just show up yesterday and start inscribing. The premise behind collecting low inscription numbers is that people believe that the narrative of holding one of the first 10,000 inscriptions on Bitcoin will resonate with collectors in a decade the same as it does to them today.

3. BRC-20

Fungible tokens are the backbone of any mature Web3 ecosystem. On Bitcoin, the protocol for fungible tokens is BRC-20, a meta protocol built on top of the Ordinals Protocol. For now, most BRC-20 tokens are meme coins, but there are a few utility tokens as well. As Bitcoin’s Web3 ecosystem matures, expect to see governance tokens, DeFi tokens, and many other types of fungible tokens emerge.

BRC-20 is unique in that it is a very simple protocol. It currently does not support staking or increasing supply. Some believe that its simplicity is its strength, while others believe these constraints are holding the standard back. It is likely that BRC-20 will evolve over time and that this will unlock new use cases such as stablecoins and much more.

2. Recursion

A recent upgrade to the Ordinals Protocol unlocked a bunch of new use cases for Bitcoin. Before the recursion upgrade, inscriptions were self-contained and unaware of each other. After the recursion upgrade, inscriptions can now use a special “/content/:inscription_id” syntax to request the content of other inscriptions.

This simple change unlocks many powerful use cases. For example, rather than inscribing 10,000 JPEG files for a PFP collection individually which would be quite expensive, you could inscribe the 200 traits from the collection and then make 10,000 more inscriptions that each use a small amount of code to request traits and programmatically render the image. The result is the same, except it was stored on-chain much more efficiently.

But let’s think bigger. What if we inscribe packages of code that everyone will be able to call? Well, that is exactly what OnChainMonkey did. They inscribed the p5.js and Three.js JavaScript packages fully on-chain and then used recursion to make calls to those packages from the inscriptions in their new Dimensions collection, allowing them to create beautiful 3D art in under 1 KB.

The best part is that anyone can do this. Now that these packages are inscribed to Bitcoin, they are a public good for everyone to use to make cool generative art inexpensively. Not only is creating generative art on Bitcoin now much less expensive, but recursion also unlocked the ability to do provably random on-chain reveals on Bitcoin. This is a keystone of the Art Blocks experience on Ethereum and was a requirement for serious generative artists and collectors to take Ordinals seriously. Now that you can effectively do everything Art Blocks does but on Bitcoin, expect higher quality generative art collections to be created with Ordinals over the coming months.

1. Rare Sats

Rare sats, also called exotic sats, or unique sats, are any sats that have some sort of special meaning. To understand rare sats, you must first understand what a sat is and its role in the Ordinals protocol. Every Bitcoin is made up of 100 million sats. The Ordinals Protocol introduces an indexing method that allows all 2.1 quadrillion sats to be individually numbered and tracked as they move throughout the Bitcoin network.

This effectively turns every sat into an NFT, so, of course, collectors find value in more unique ones. For example, sats from the 10,000 BTC transaction used to purchase two Papa John’s pizzas in May 2010 are interesting to collectors. There is a very high supply of them, however, there is a “cool factor” that is hard to ignore. You could sort of think of them as a meme coin. Another example is sats from Block 9. These are the oldest sats in circulation and were mined by Satoshi Nakamoto and sent to Hal Finney in the first Bitcoin transaction ever.

Casey Rodarmor, the creator of the Ordinals Protocol, also built his own rarity system into Ordinals, which establishes arbitrary layers of rarity such as Uncommon, Rare, and Epic. An Uncommon sat, for example, is the first sat mined in every block. When a sat is not inscribed on, it is referred to as a “virgin sat.”

Things get interesting when artists combine rare sats with inscriptions. Because every inscription points to a sat which is how its ownership is tracked, some artists choose to inscribe on special sats to amplify their art. For example, the rare sat hunter and artist, Nullish inscribed art of the number nine on the first nine inscriptions on Block 9 sats. Not only can certain rare sats underpin the value of an inscription, but they can also be incorporated into the art itself in a way that could only be done on Bitcoin.

Leonidas is a self-proclaimed NFT historian and Ordinals collector who co-hosts The Ordinal Show and is currently building the Ord.io platform.