- Wallets that hold between 1 and 100 BTCs have taken to selling off their assets.

- While sentiment remains negative, accumulation continues in the general market.

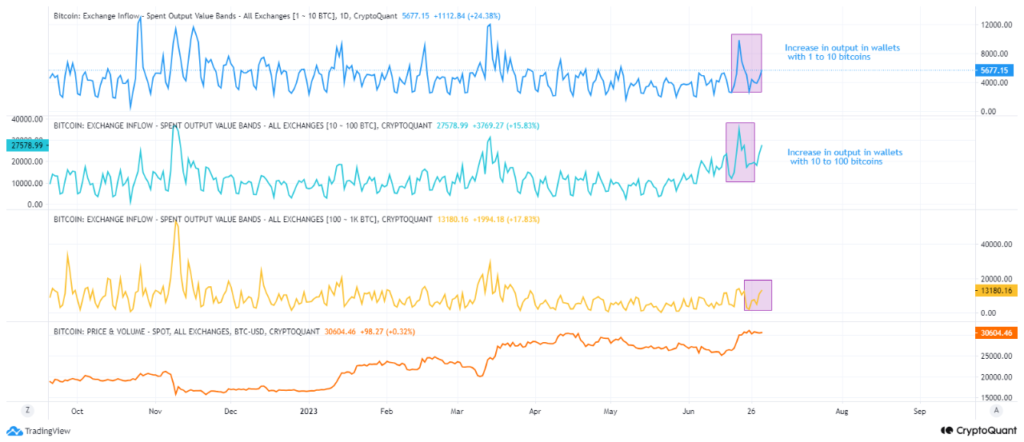

Holders with 1-100 Bitcoins (BTC) in their custody have increased coin distribution in the past few days as general sentiments remain sour, pseudonymous CryptoQuant analyst CryptoOnchain, found in a new report.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Following an assessment of BTC’s Spent Output indicator for wallets that hold between 1 to 100 BTCs, CryptoOnchain found that a great percentage of the leading coins has been moved or spent from these wallets in the past few days.

Source: CryptoQuant

Generally, a surge in Spent Output from this cohort of BTC holders typically suggests a potential increase in selling activity by these investors. This could be driven by various factors such as profit-taking, market sentiment, or the belief that the price may decline further.

However, it could also mean these investors have spent the last few days transferring their BTC holdings to other entities.

Analyst CryptoOnchain found further that the biggest increase in spent output in the last few days was observed in wallets that held between 10 to 100 BTCs. The analyst noted:

“The biggest increase can be seen in wallets with 10 to 100 bitcoins, which after the increase of the last few days to about 36,170 bitcoins, are currently around 28,000.”

The decision to decrease their BTC holdings might be due to a persistent decline in the positive sentiment. Per Santiment, BTC’s weighted sentiment has been negative since 9 June. It lingered below the center line at press time to return a negative -1.048.

Hold on to your horses

While weighted sentiment remained in the negative territory, an assessment of BTC’s exchange activity revealed a decline in the leading coin’s exchange reserve. This metric tracks the total number of BTCs held within exchanges. When the value of this metric goes up, this suggests a rally in selling pressure, while a decline indicates increased accumulation.

Is your portfolio green? Check out the Bitcoin Profit Calculator

According to data from CryptoQuant, BTC’s exchange reserves trended downwards between 2 and 25 June, after which it experienced a surge till the end of Q2. Price movements during that period revealed severe volatility. This could have pushed many to exit their trade positions and send their BTC to exchanges for sale.

However, things have normalized in the past two days as the metric has declined since the beginning of July.

Source: CryptoQuant

Further, while a particular cohort of BTC holders might have taken to selling, buying activity continued unabated amongst others. A look at BTC’s movements on the price chart confirmed this.

At press time, key momentum indicators RSI and MFI, rested above their neutral positions at 65.57 and 71.16, respectively. At these spots, the king coin was close to being overbought.

While the coin inched closer to overbought highs at press time, its price rested close to the upper band of its Bollinger Bands indicator. At this level, it may encounter resistance, leading to a pullback or a period of consolidation.

Source: BTC/USDT on TradingView