Bitcoin has plunged during the last 24 hours and now finds itself at the $26,200 level. Here’s why this level is important for the asset.

Bitcoin 200 WMA & 111 DMA Are Both At $26,200 Right Now

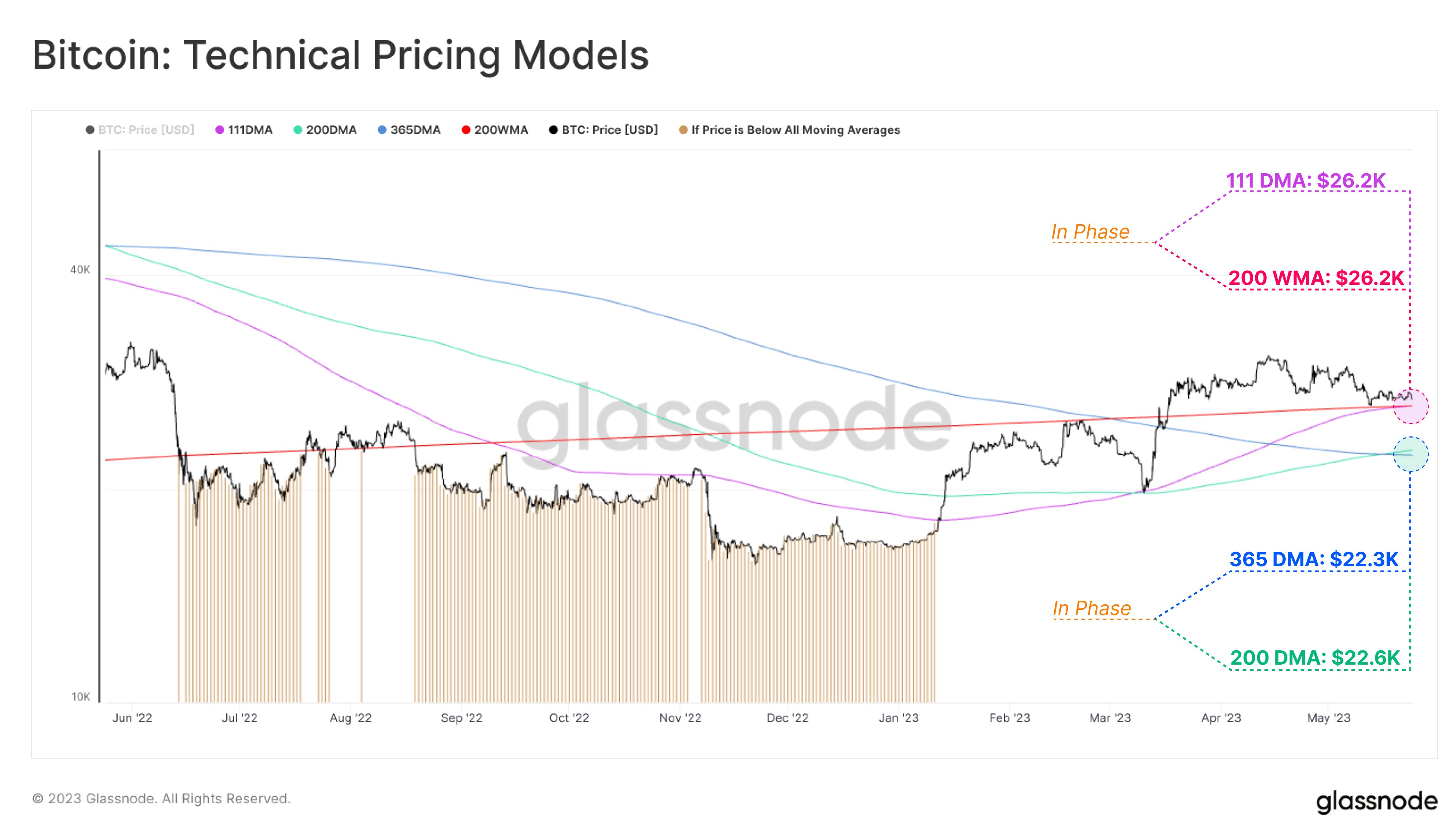

In a new tweet, the analytics firm Glassnode has talked about how the different technical pricing models for Bitcoin may be interacting with the asset’s price currently.

There are four relevant technical pricing models here, and each of them is based on different moving averages (MAs) for the cryptocurrency.

An MA is a tool that finds the average of any given quantity over a specified region, and as its name implies, it moves with time and changes its value according to changes in said quantity.

MAs, when taken over long ranges, can smooth out the curve of the quantity and remove short-term fluctuations from the data. This has made them useful analytical tools since they can make studying long-term trends easier.

In the context of the current topic, the relevant MAs for Bitcoin are 111-day MA, 200-week MA, 365-day MA, and 200-day MA. The first of these, the 111-day MA, is called the Pi Cycle indicator, and it generally finds useful in identifying short to mid-term momentum in the asset’s value.

The 200-week MA is used for finding the baseline momentum of a BTC cycle as 200 weeks are equal to almost 4 years, which is about what the length of BTC cycles in the popular sense is.

Here is a chart that shows the trend in these different Bitcoin technical pricing models over the past year:

Looks like pairs of models have come together in phase in recent weeks | Source: Glassnode on Twitter

As shown in the above graph, these different Bitcoin pricing models have taken turns in providing support and resistance to the price during different periods of the cycle.

For example, the 111-day MA turned into support recently, as the price rebounded off this level back during the plunge in March of this year, as can be seen in the chart.

The 111-day and 200-week MAs have recently come into phase, as both their values stand at $26,200 right now. This is the level that Bitcoin has been finding support at in recent days, so it would appear that the base formed by these lines may be helping the price currently.

Glassnode notes that if a break below this region of support takes place, the next levels of interest can be the 365-day and 200-day MAs. The former of these simply represent the yearly average price, while the latter metric is called the Mayer Multiple (MM).

The MM has historically been associated with the transition point between bullish and bearish trends for the cryptocurrency. When the 111-day MA provided support to the price back in March, the metric had been in phase with the MM.

From the graph, it’s visible that the 365-day and 200-day MAs have also interestingly found confluence recently, as their current values are $22,300 and $22,600, respectively. This would imply that between $22,300 and $22,600 may be the next major support area for the asset.

BTC Price

At the time of writing, Bitcoin is trading around $26,200, down 4% in the last week.

BTC has plunged during the past day | Source: BTCUSD on TradingView

Featured image from iStock.com, charts from TradingView.com, Glassnode.com