Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- ETH posted over 2% gains as of press time.

- Long positions were discouraged.

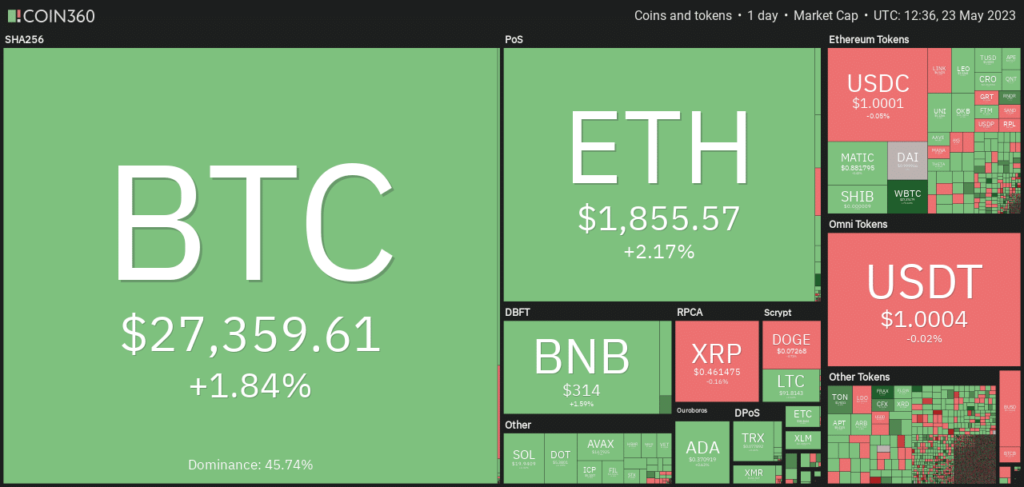

Ethereum [ETH] started the week on a positive note, posting about 4% gains, since Monday (22 May). At press time alone, the gains stood at 2.2% on a daily basis, with Bitcoin [BTC] comfortably back at $27k.

Is your portfolio green? Check ETH Profit Calculator

Source: Coin360

In a recent development, Vitalik echoed concern about pushing Ethereum on a multi-purpose path. Although the price didn’t react to his concerns, here is the state of ETH’s short-term prospects.

The rally eased at the short-term range high

Source: ETH/USDT on TradingView

Since 8 May, ETH has been oscillating between $1740 – $1873. At press time, it retested the range of $1873 but left behind an FVG (fair value gap) of $1825 – $1846 (white).

The FVG could hold further drop, giving bulls a chance to retest or smash the range high. A bullish breakout could set ETH to reclaim the $1900 and $2000 psychological levels.

However, a drop below the FVG zone could ease at the mid-range of $1807. A session close below the mid-range could tip sellers to drag ETH to $1784 or range low of $1740.

Meanwhile, the RSI value was 67, highlighting an increased buying pressure in the past few hours. Similarly, the OBV increased confirming improved ETH volume and demand.

Longs discouraged

Source: Coinglass

Read Ethereum’s [ETH] Price Prediction 2023-24

As per Coinglass, longs suffered more liquidations at press time, with about $300k worth of positions wrecked. The trend could undermine a strong retest of the range high as the data paints a bearish outlook in the futures market.

Similarly, ETH long/short ratio showed sellers had a little upper hand at press time, commanding a dominance at 52.98% on the 4-hour timeframe.

As such, more upside moves could delay for a while before ETH attempts to break above the range high. BTC’s movement could offer more clarity on the direction.

Source: Coinglass