Data shows that Bitcoin active addresses have sharply dropped despite the high transaction demand; here’s why this may be happening.

Bitcoin Active Addresses Have Seen A Sharp Plunge Recently

According to the latest weekly report from Glassnode, the active addresses are around cyclical lows of 566,000. The “active addresses” metric measures the daily number of unique Bitcoin addresses participating in some transaction activity on the blockchain.

By “unique,” what’s meant here is that the indicator only checks whether an address has been involved in a transfer at least once. This implies that regardless of how many transactions an address might make, its contribution to the active addresses metric will remain just one unit.

This restriction exists because the number of unique addresses can serve as an analog to the number of unique users visiting the blockchain, thus providing an estimate for the daily users on the network.

Another indicator that’s made for tracking activity on the Bitcoin blockchain is the “transaction count,” which, as its name already suggests, tells us about the daily total number of transfers taking place on the network.

When this metric has a high value, it naturally means that many transactions occur on the blockchain. Such indicator values imply a high demand for using the network currently, but the metric can’t say anything about how the activity is distributed; that’s where the active addresses indicator comes in.

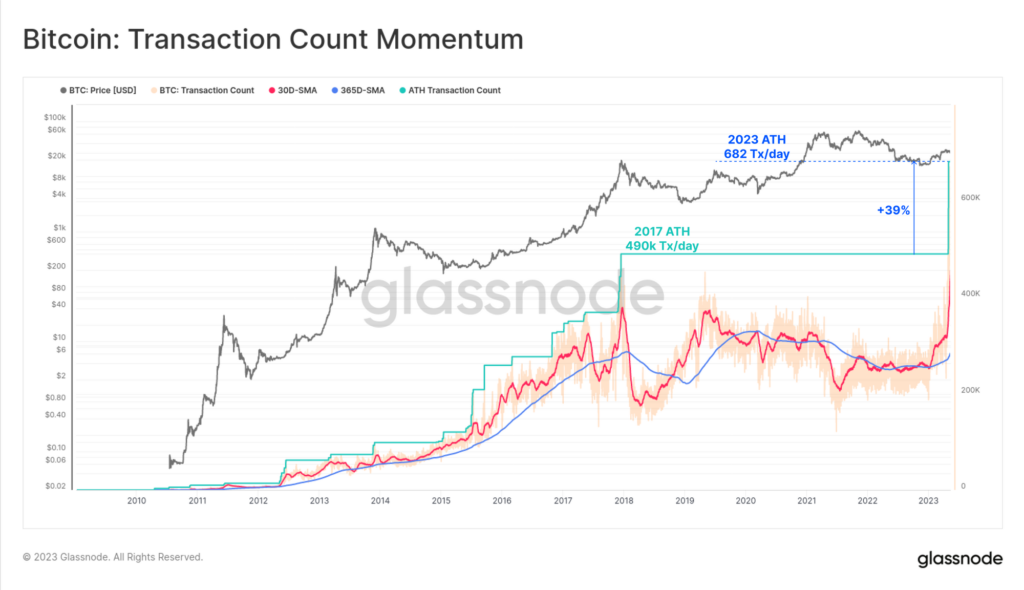

Now, here is a chart that shows the trend in the Bitcoin transaction count (as well as its 30-day and 365-day simple moving averages) over the entire history of the asset:

The value of the metric seems to have sharply surged recently | Source: Glassnode's The Week Onchain - Week 20, 2023

As displayed in the above graph, the Bitcoin transaction count has recently seen a rapid rise and has hit a new all-time high of about 682,000 daily transfers.

The reason behind this explosion in the transaction count is the emergence of the BRC-20 tokens, fungible tokens created on the BTC blockchain using the Ordinals protocol (a way to inscribe data like text and images directly into the chain).

These BRC-20 tokens have started a new memecoin mania, with PEPE being the largest example of such a coin. The insanely fast popularity of these tokens has meant that the demand for transacting on the network is more than ever before.

What about the active addresses, though? Is this indicator also seeing a rise?

Looks like the metric has plunged recently | Source: Glassnode's The Week Onchain - Week 20, 2023

From the chart, it’s apparent that the active addresses observed a rise at first, but then it plunged to a value of 566,000 addresses per day, around the current cyclical low.

This would mean that while the demand for making transactions is super high right now, the demand isn’t actually coming from a large number of users but a rather small number of them who are constantly making repeat transfers.

“This is a curious scenario, whereby many BRC-20 users appear to have re-used their Bitcoin addresses,” explains Glassnode. “Perhaps due to having more familiarity with how account-based chains like Ethereum or Solana operate, and less so with the Bitcoin UTXO system.”

BTC Price

At the time of writing, Bitcoin is trading around $27,400, down 1% in the last week.

BTC has shot up over the last 24 hours | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com