beginner

In recent years, cryptocurrencies have been a topic of interest, excitement, and debate, with both supporters and detractors expressing strong opinions on their future. The question on everyone’s mind is: Is crypto dead?

Recently, a billionaire tech investor Chamath Palihapitiya claimed that crypto is pretty much dead in the United States — mainly because of the strict regulations imposed by the SEC. It remains to be seen how much those regulations will actually do to destroy the crypto market in the States and whether crypto assets will be able to weather this storm. However, we can still examine things we do know — existing crypto projects and businesses.

In this article, we’ll examine various aspects of cryptocurrency, its history, the current state of the market, and its potential future to determine if crypto is truly dead or if it’s simply experiencing growing pains.

Spoiler alert: Personally, I think the answer so far is a resolute “no.” But what do you think? Will crypto crash or will crypto recover?

What Is Cryptocurrency?

A cryptocurrency is a digital asset that relies on cryptography and blockchain technology to enable secure, decentralized transactions. Unlike traditional currencies, cryptocurrencies are not regulated by central authorities, such as governments or financial institutions. This decentralization allows for faster transactions, lower fees, and increased privacy. Some of the most popular cryptocurrencies include Bitcoin, Ethereum, and XRP.

History of Cryptocurrency

The concept of digital currencies can be traced back to the 1980s, but the actual implementation of a decentralized cryptocurrency began with the creation of Bitcoin in 2009 by an individual or a group known as Satoshi Nakamoto. Bitcoin was designed to address the flaws in the existing financial system, including the lack of transparency and the potential for a banking crisis and control inherent in centralized financial institutions.

Over the years, many other cryptocurrencies have been created, each with its unique features and use cases. While the market has experienced significant fluctuations and several bear markets, the overall trajectory has been one of growth and increased adoption. The most notable milestones in the crypto market were the initial Bitcoin boom and the following “altseason” of 2017.

Two of the crypto market’s most significant peaks both happened during the same year — 2021. That was when Bitcoin achieved its (at the time of writing) all-time high, and almost every crypto exchange was brimming with visitors. After those highs, however, came the lows — and the crypto industry got caught up in a long bear market.

How is the Crypto Market Doing Right Now?

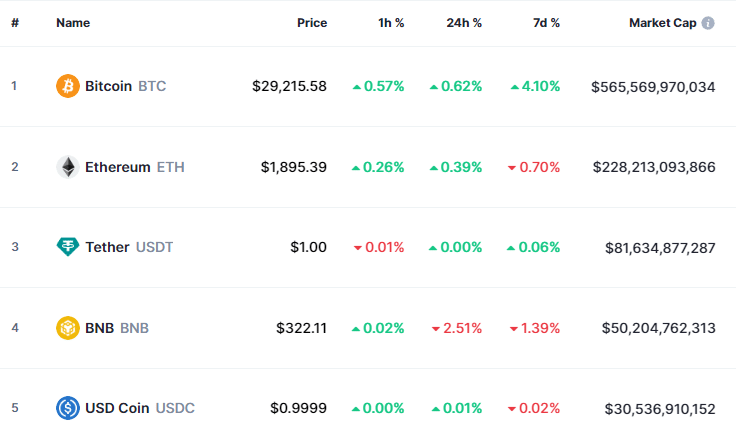

The crypto market has experienced a fair share of ups and downs, with periods of rapid growth followed by sharp declines. Despite these fluctuations, the overall trend has been positive: more people and businesses have been adopting digital assets, and the market capitalization of cryptocurrencies has been reaching new heights.

There have been a few large-scale scandals, like the one with Sam Bankman-Fried and the collapse of his crypto company FTX — a cryptocurrency exchange and crypto hedge fund. However, even despite scandals like that, the crypto “bubble” hasn’t popped yet.

Several major financial institutions and businesses, such as JPMorgan and Square, have also started to invest in and offer cryptocurrency-related services, signaling a growing acceptance of digital assets as a legitimate asset class.

Let’s take a look at how the cryptocurrency market is doing right through the lens of its various use cases.

Cryptocurrency as an Investment

As cryptocurrencies have become more popular, they have attracted the attention of investors who view them as an alternative investment opportunity. While some have achieved significant gains by investing in cryptocurrencies, others have experienced losses due to the volatile nature of the market.

Despite the risks, many retail and institutional investors alike continue to be attracted to the potential for high returns and the opportunity to diversify their portfolios with digital assets. As the market matures and regulatory frameworks are established, cryptocurrencies will likely continue to gain acceptance as a viable investment option.

Crypto and Business

Apart from being an investment option, cryptocurrencies offer numerous benefits and opportunities for businesses. For instance, accepting cryptocurrency as a form of payment can help businesses reach a broader customer base, lower transaction costs, and increase transaction speeds.

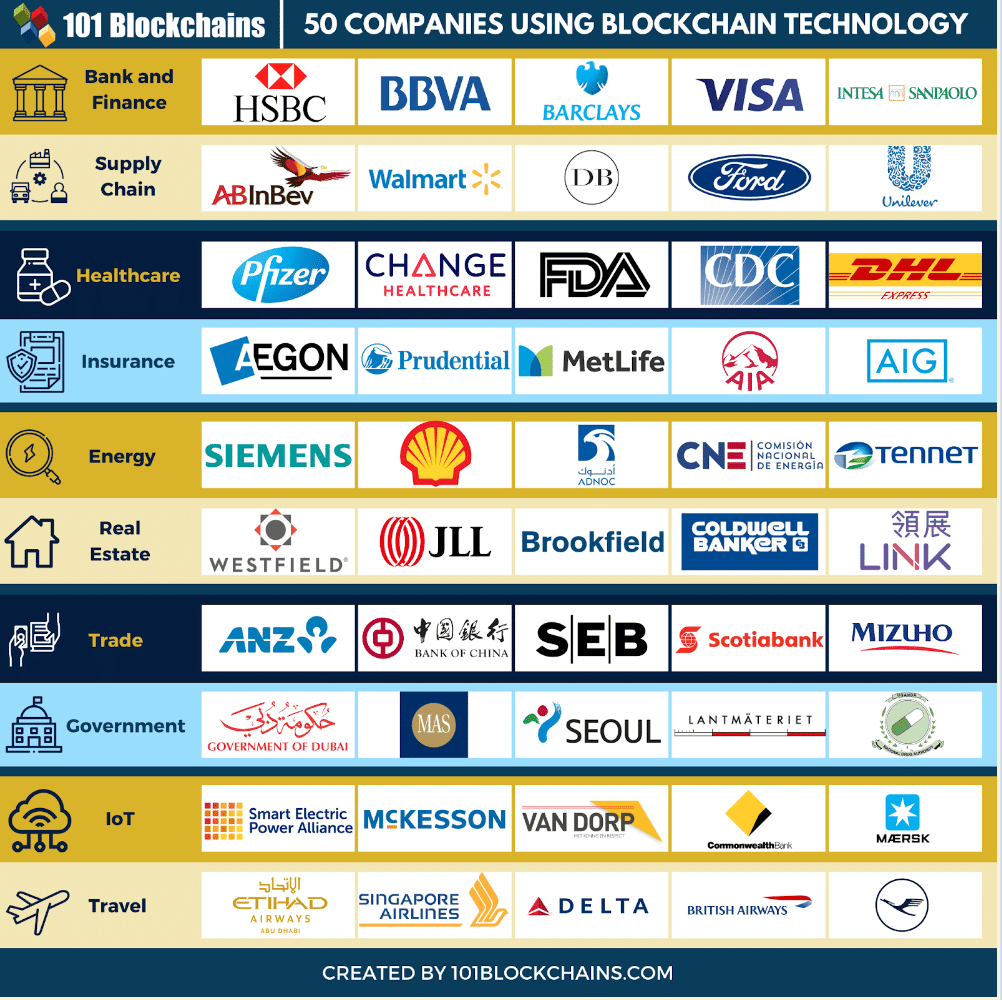

Furthermore, blockchain technology, which underpins cryptocurrencies, has a wide range of applications beyond digital currencies. Businesses can use blockchain to improve supply chain management, create secure digital identities, and facilitate transparent and efficient data sharing.

Some major corporations, such as Tesla and Microsoft, have begun to accept cryptocurrency payments, and more businesses are expected to follow suit as the market continues to grow and mature.

There are also numerous digital asset firms — not only companies that directly work with crypto (exchanges, wallets, etc.) but also projects that simply use crypto tokens to enhance their existing services, like games and community hubs. Such platforms have a lot to gain from crypto and blockchain technology.

Crypto Regulation

As the adoption of cryptocurrencies has increased, so has the attention of regulators and governments worldwide. For example, the SEC has proposed new rules on how crypto companies can custody customer assets and issued some official warnings to Coinbase. Many countries are now working to develop and implement regulatory frameworks to govern the use of digital assets and crypto trading platforms, protect consumers, and prevent illicit activities such as money laundering and fraud.

While some have criticized regulations for potentially stifling innovation and growth, others argue that a clear regulatory environment will help legitimize cryptocurrencies and promote their adoption on a larger scale. For example, in the United States, the Office of the Comptroller of the Currency (OCC) has granted several crypto firms, including Paxos and Anchorage, conditional approval to operate as federally chartered banks. This development signifies a growing acceptance of cryptocurrencies within the traditional financial system.

Institutional interest in cryptocurrencies has also grown, with major financial players like the Silicon Valley Bank exploring partnerships with cryptocurrency companies and offering crypto-related services. As regulatory clarity improves, it is likely that more financial institutions and businesses will enter the cryptocurrency space, further bolstering the market’s growth.

So, Is Crypto Dead?

Considering the current state of the cryptocurrency market, crypto companies, and major cryptocurrencies, it’s clear that crypto is far from being dead. While the market has experienced fluctuations and faced regulatory challenges, the overall trend has been one of growth, innovation, and increased adoption.

The increasing interest in digital assets and blockchain technology from investors, businesses, and governments demonstrates that cryptocurrencies are becoming more widely accepted and integrated into the global financial system.

Some people argue that the reason why crypto had such rapid growth in the past was all due to lack of regulation — but we don’t know what those future regulations and security laws will look like and whether they will be able to stop the growth of a fully decentralized, borderless asset.

In conclusion, while the future of cryptocurrencies is not without risks and uncertainties, it’s evident that these assets have come a long way since their inception and will continue to shape the future of finance and technology. Crypto, in all likelihood, is here to stay, and the question “Is crypto dead?” can be confidently answered with a resounding “no.”

FAQ

Why are cryptocurrencies crashing? And will they recover?

Cryptocurrencies are subject to volatility and can experience significant price fluctuations due to various factors, such as changes in market sentiment, regulatory developments, and macroeconomic factors affecting financial markets. It’s essential to understand that market crashes are not unique to cryptocurrencies and can occur in traditional financial markets as well.

Cryptocurrencies may crash due to negative news or events, such as regulatory crackdowns or security breaches on crypto exchanges. These events can lead to panic selling among investors, causing prices to drop rapidly. However, history has shown that cryptocurrencies tend to recover after a crash, although the timeline and extent of the recovery may vary.

Many investors are optimistic about the long-term prospects of cryptocurrencies, especially as blockchain technology continues to develop and find new use cases. Although it’s impossible to predict the future with certainty, the overall trend in the cryptocurrency market has been one of growth and increased adoption, suggesting that cryptocurrencies are likely to recover from crashes over time.

Is crypto a bad investment?

The answer to whether crypto is a bad investment depends on your individual risk tolerance, investment goals, and knowledge of the cryptocurrency market. Cryptocurrencies are known for their volatility, which means that they can offer significant potential returns but also come with a higher level of risk compared to more traditional investments.

For some investors, the potential rewards of investing in cryptocurrencies outweigh the risks, while others may prefer to stick with more traditional investment options. It’s essential to conduct thorough research and understand the risks before deciding to trade crypto or invest in digital assets.

Diversification is a key principle in investing: many investors choose to allocate a portion of their portfolio to cryptocurrencies to spread their risk and take advantage of the potential growth in the market. In any case, it’s crucial to invest only what you can afford to lose and seek professional advice if needed.

Is Bitcoin dead?

Despite periodic price drops and negative news surrounding the cryptocurrency market, Bitcoin is far from being dead. Since its inception in 2009, Bitcoin has experienced several crashes and periods of decline, but it has consistently recovered and continued to grow over time.

Bitcoin remains the largest and most well-known cryptocurrency, with a market capitalization that dwarfs most other digital assets. It has attracted the interest of many investors, businesses, and even governments, which view it as a store of value, a hedge against inflation, or a means of conducting transactions more efficiently.

As the first and most established cryptocurrency, Bitcoin has proven its resilience and adaptability in the face of challenges. While it’s impossible to predict the future with certainty, the overall trend for Bitcoin has been one of growth and increased adoption, indicating that it is far from dead and will likely continue to play a significant role in the world of digital assets.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.