– Only a few traders had open contracts based on the funding rate and open interest.

– There is only a little discrepancy between the futures market and the BTC directional bias.

There is no doubt that the Bitcoin [BTC] stopover around $30,000 has been fueled by increased demand in the market. Needless to say, some of the major drivers of the price action include the supply and demand dynamics, investor sentiment, and macroeconomic conditions.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

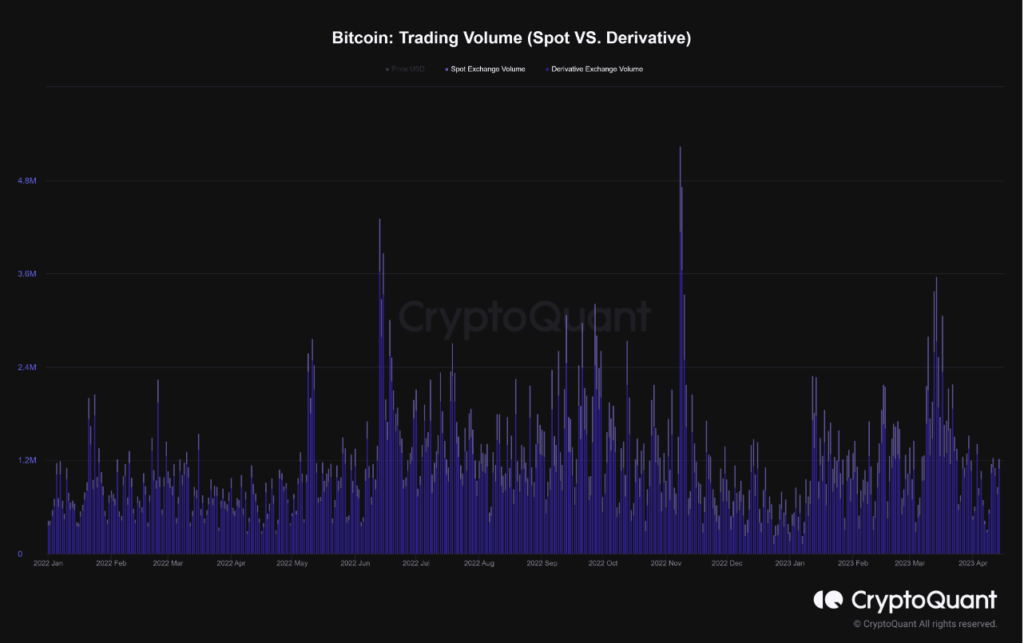

But at the same time, the interplay between the spot market and activities in the derivatives market are also subjects of intense speculation for BTC.

In quick summary, traders engage in spot for immediate delivery of a transaction settlement in the underlying asset. In contrast, the derivatives market consists of instruments, including options, futures, and swaps that derive their value from the said asset without actual ownership.

Do traders now love tranquility?

But in times past, the futures market has had more influence on the Bitcoin price action than the spot demand. However, recent data, according to CentralCrypto, noted that the opposite was the case.

According to the analyst’s opinion posted on CryptoQuant, the futures market leverage over BTC had substantially drowned. Instead, the cumulative delta signal showed that the spot activity was driving the momentum.

![Bitcoin [BTC] spot trading volume and derivatives volume](https://statics.ambcrypto.com/wp-content/uploads/2023/04/Screenshot-2023-04-16-at-09.50.12.png)

Source; CryptoQuant

From the image above, it was clear that the volume into the spot market had outpaced that of the derivatives. Hence, this suggests that quick asset transactions were happening far more than open contracts.

CentralCrypto also pointed to the Open Interest (OI) trend. The OI defines the number of open long and short positions on exchanges. Usually, an increasing OI implies more volatility, liquidity, and attention toward the derivatives market.

But when the metric decreases, it means investors are closing their options or futures position. The analyst had observed the decline in the metric and noted that:

“In this period of lateralization, the number of derivative contracts compared of market size continued to decline, indicating a reduction in the demand for the use of derivatives.”

Spot: Neutralizing the control of the contango

Thus, this implied that there was only a minimal sign of a short squeeze since traders have not been fueling buy calls for more upside. This was again confirmed by the Estimated Leverage Ratio (ELR). The metric refers to the OI proportion to the reserves on exchanges.

At the time of writing, the ELR had decreased to a very low point. According to Glassnode, the ratio was 0.22. Such a low ELR often coincides with volatility and strength in the spot market, as traders seem to be taking leverage risk off the markets.

![Bitcoin [BTC] estimated leverage ratio](https://statics.ambcrypto.com/wp-content/uploads/2023/04/glassnode-studio_bitcoin-futures-estimated-leverage-ratio-all-exchanges.png)

Source: Glassnode

As previously indicated, there are few open contracts. And from the funding rate, bias seems to have remained neutral based on Coinglass.

Is your portfolio green? Check the Bitcoin Profit Calculator

When the funding rate increases, it means that the price of the perpetual contract is higher than the market price. Here, longs pay shorts. But when the rate is negative, the opposite happens and short positions pay for longs.

![Bitcoin [BTC] funding rate](https://statics.ambcrypto.com/wp-content/uploads/2023/04/bybt_chart-7-1.png)

Source: Coinglass

Hence, this implies that price action has been controlled majorly by the impulse of spot trading. Therefore, liquidity coming into the derivatives market might have lost the reign to push a healthy curve. Barring any changes, sentiment might continue to determine the BTC direction.

OCTA: Things Are Melting Up Quietly

OCTA: Things Are Melting Up Quietly