Popular on-chain crypto analyst Willy Woo thinks certain metrics are hinting that Bitcoin (BTC) is about to take off on a big move.

Woo tells his one million Twitter followers that Bitcoin’s cost-basis analysis could signal that BTC’s re-accumulation phase has begun.

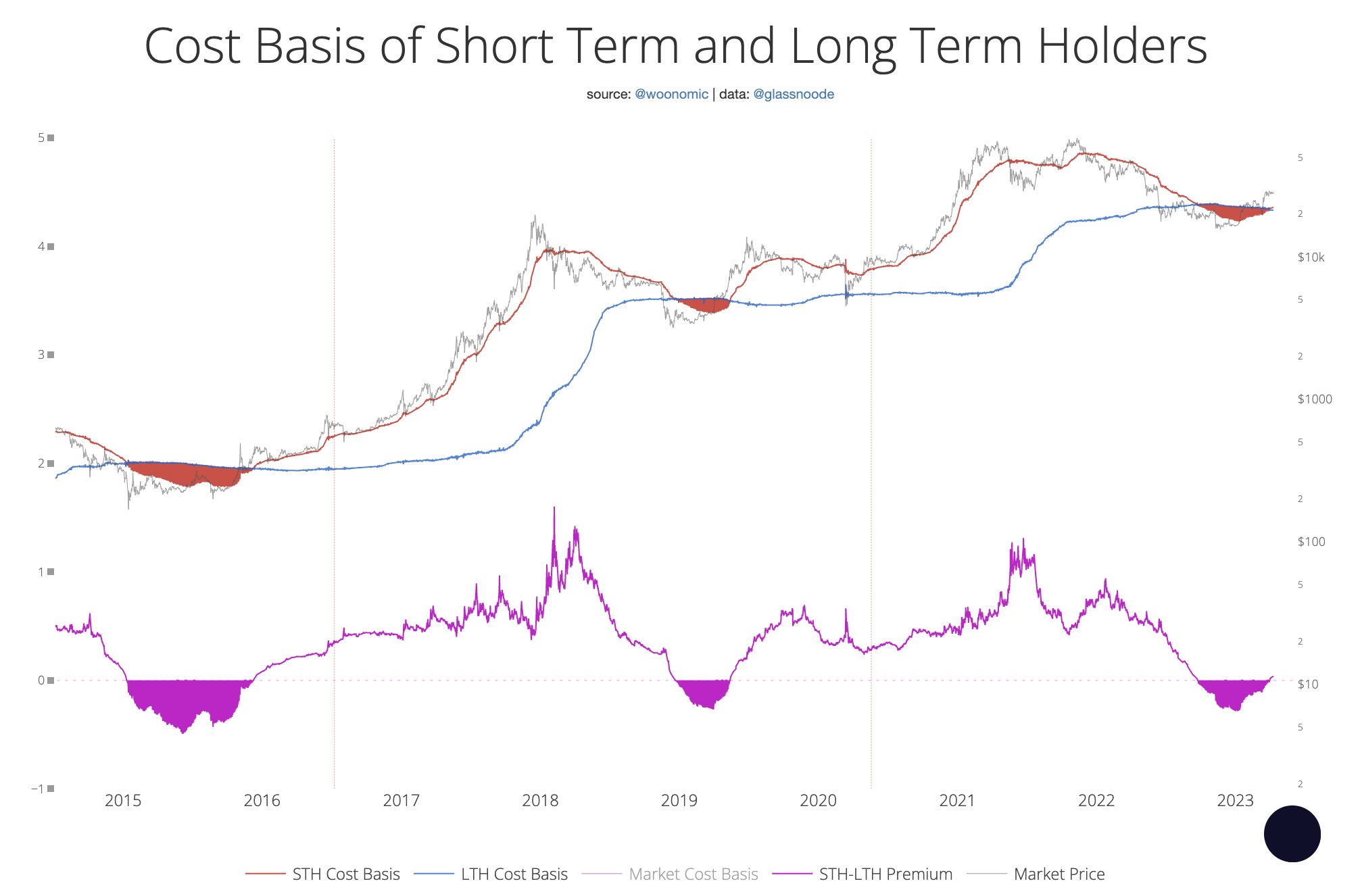

The analyst shares a chart showing the cost basis of long-term holders (LTHs), or those who have held onto Bitcoin for at least 155 days, and short-term holders (STHs).

According to Woo, STHs have a lower cost basis than LTHs, suggesting that Bitcoin has already carved a bear market bottom in the last few months and is now about to enter a new phase.

“Bottoms are signaled when short-term holders (recent buyers) got in cheaper than long-term holders. We are now moving out of this regime.”

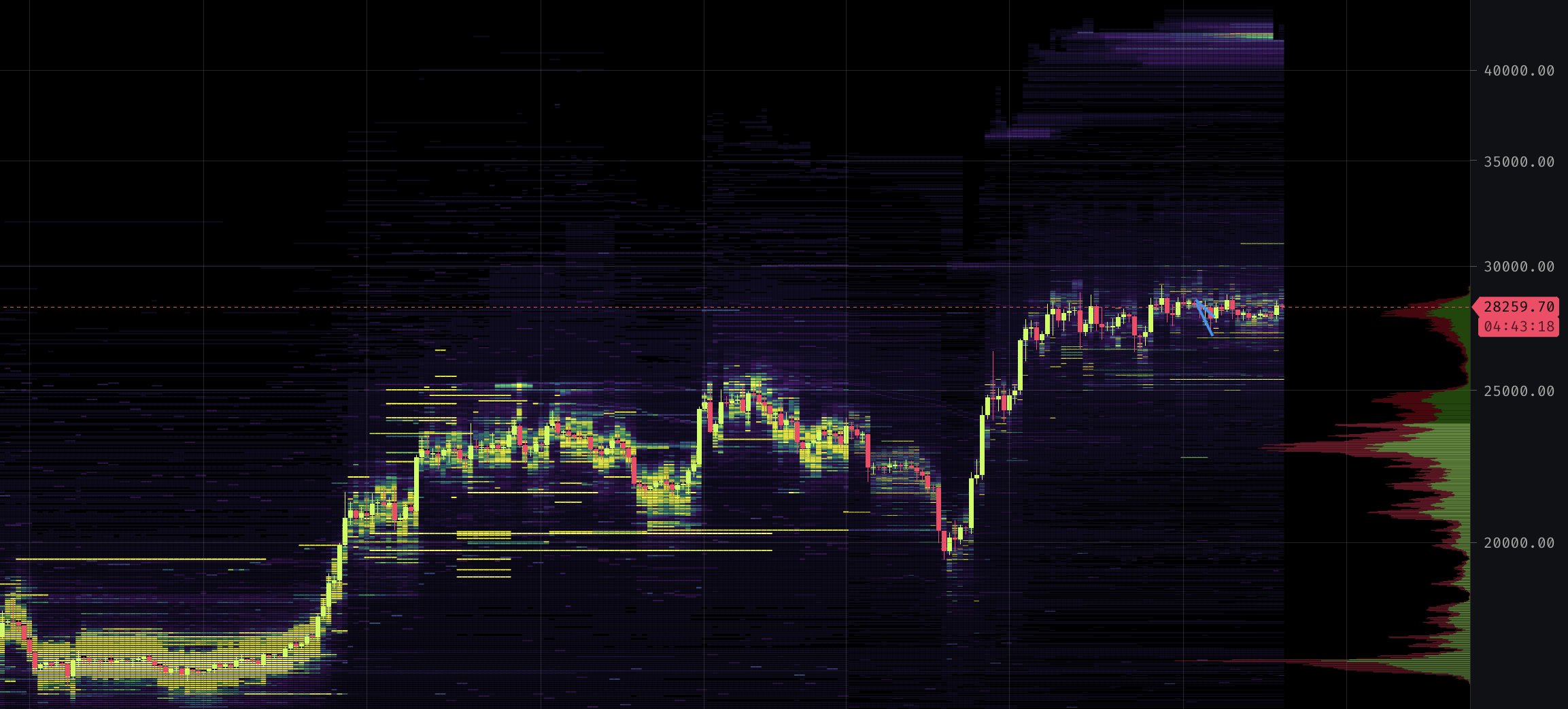

The analyst also says “April will be an interesting month to watch” for BTC as sellers are nowhere to be seen until $40,000.

“Orderbook liquidity is thinning out, and a big liquidity gap from here to $40,000. Volatility ramping up is a near certainty.”

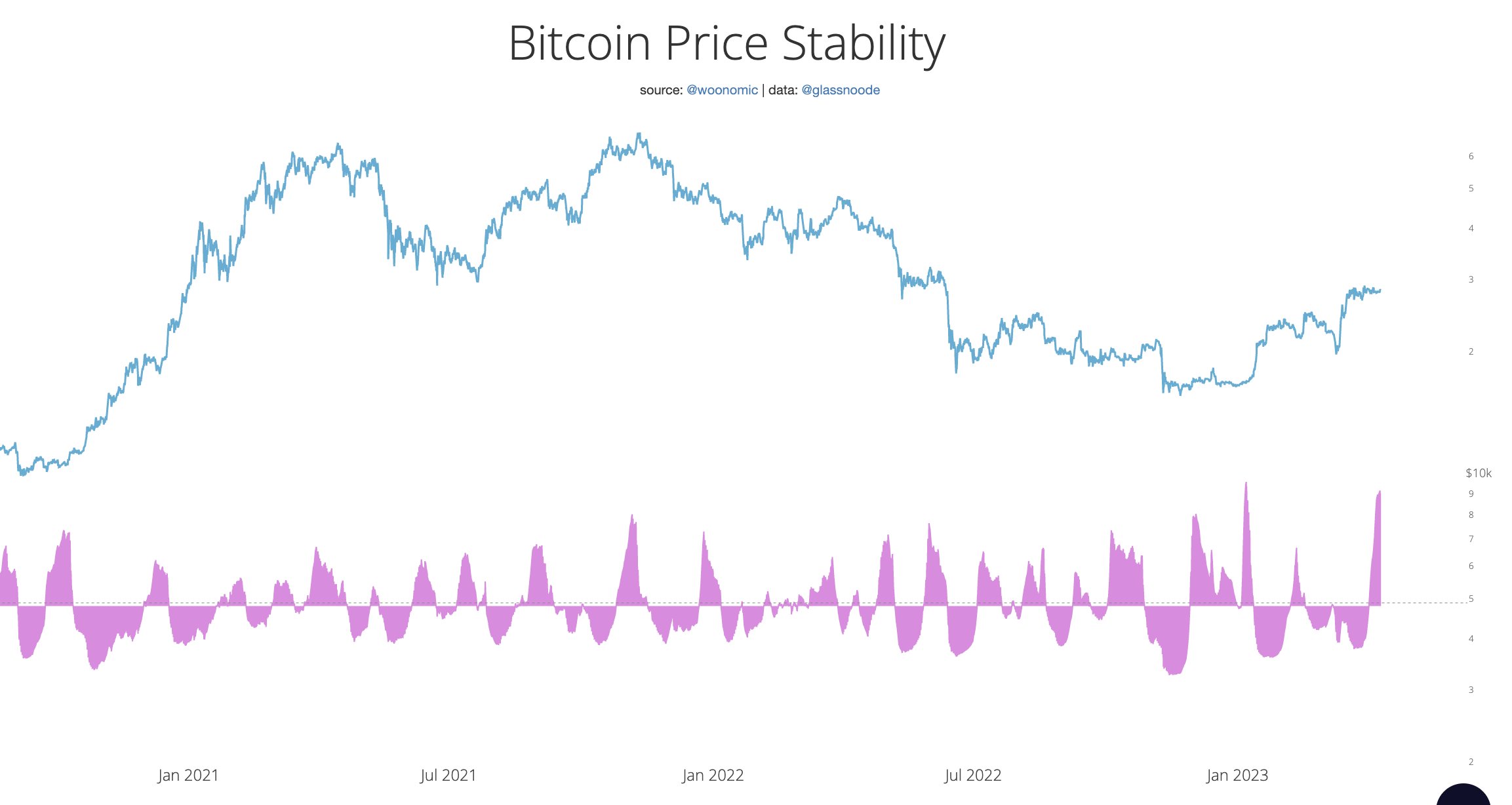

Woo notes that Bitcoin’s price stability is forming a peak, which could be an indication that it’s about to take off in price.

“Price stability forming a peak, this is probabilistically a prelude to a big move (usually happens within a week).”

Bitcoin is trading at $30,023 at time of writing. The top-ranked crypto asset by market cap is up more than 7% in the past 24 hours.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney