- DOGE long positions dominated the market even though most suffered liquidation.

- Traders have the backing of the MVRV intraday ratio in expecting a rally.

During the last bull market, a simple mention of Dogecoin [DOGE] by Elon Musk would have resulted in a quick uptick for the memecoin. However, the reaction seems to have slowed down in recent times even as the Twitter CEO remains a big admirer of the project.

Read Dogecoin’s [DOGE] Price Prediction 2023-2024

Musk has reduced his mention of the coin as he looks occupied with resolving issues at his recently acquired company. But it may seem that DOGE has become worse off per its Bitcoin [BTC] correlation.

Cool, calm, and liquidated

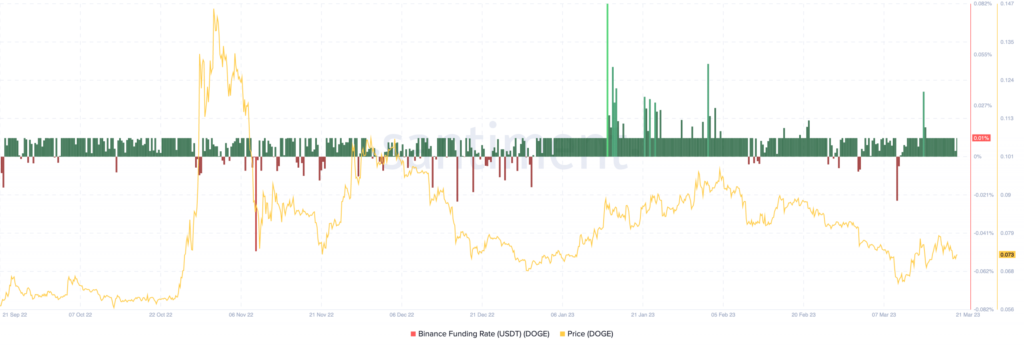

Unfazed by that, traders of the cryptocurrency have stayed true to their optimism in expecting a rally. A confirmation of this stance was revealed by Santiment. According to the on-chain analytic provider, the Binance funding rate of the coin was 0.01% at press time, despite DOGE registering a notable decrease in the last seven days.

Source: Santiment

The funding rate of an asset shows the difference in spot and derivative market prices. In addition, it also reveals if long-positioned traders are paying shorts or vice versa.

But since the metric was positive, it meant that traders had confidence in a short-term price increase. Moreso, they were prepared to pay short for the bet.

Interestingly, the futures Open Interest (OI) for the cryptocurrency increased in the last four hours. This means that more traders opened more DOGE contracts than they closed within the period. Furthermore, Coinglass data showed the enthusiasm was not yet paid off.

According to the real-time derivatives information portal, longs have had the most liqudations. And this has been the case since 18 March. At the time of writing, about $1.85 million DOGE positions have been exterminated. Out of this number, longs accounted for $1.33 million of the wipeout.

![Dogecoin [DOGE] liquidations](https://statics.ambcrypto.com/wp-content/uploads/2023/03/Screenshot-2023-03-21-at-13.39.52.png)

Source: Coinglass

Hope in the face of instability

However, it seemed that DOGE traders were not alone concerning the discernment of the coin. A further evaluation of Santiment’s data showed that weighted sentiment has severely dwindled.

This metric takes into account the social-volume sentiment balance. When the value is high, it depicts a strong positive perception. But when it is negative, like it was -0.107 at press time, it means a majority of the messages around the asset were not largely positive.

How much are 1,10,100 DOGEs worth today?

Besides, the 30-day Market Value to Realized Value (MVRV) intraday ratio was down to -.1394%. The metric reveals the unrealized profit and loss of addresses who acquired DOGE in the last 30 days.

Since the value was low, it signaled a potential opportunity to long DOGE while watching out for the danger zone.

Source: Santiment