- MakerDAO has a new proposal to introduce a debt ceiling breaker.

- MKR has commenced a new bear run.

In a new emergency executive proposal, leading DeFi platform MakerDAO [MKR] has sought community approval to introduce a debt ceiling breaker for collateral assets used to mint its DAI stablecoin.

Read MakerDAO’s [MKR] Price Prediction 2023-2024

This action became necessary after USD Coin [USDC] lost its parity with the U.S. dollar last weekend due to the disclosure that Circle, the issuer, held deposits at Silicon Valley Bank (SVIB). As USDC was a significant collateral backing for DAI, its de-pegging event resulted in a temporary loss of dollar parity for DAI.

With this new proposal, the DeFi protocol aims to implement a mechanism to set the debt ceiling of any collateral type to zero on the Maker protocol.

MakerDAO’s debt ceiling refers to the maximum number of DAI tokens that can be generated against the value of the collateral assets locked in the Maker protocol. The debt ceiling is set individually for each type of collateral the protocol accepts. The purpose of the debt ceiling is to maintain the stability of the MakerDAO system by limiting the number of DAI that can be issued,

By introducing a debt ceiling breaker, MakerDAO aims to handle scenarios where the underlying collateral asset is experiencing substantial volatility. This mechanism would enable MakerDAO to safeguard its liquidity and prevent losses in such situations.

MKR demand falters, prices suffer

Because of its statistically significant positive correlation with Bitcoin [BTC], the growth in the king coin’s price following Federal Regulators’ decision to make all SVIB depositors whole resulted in a temporary price rally for MKR.

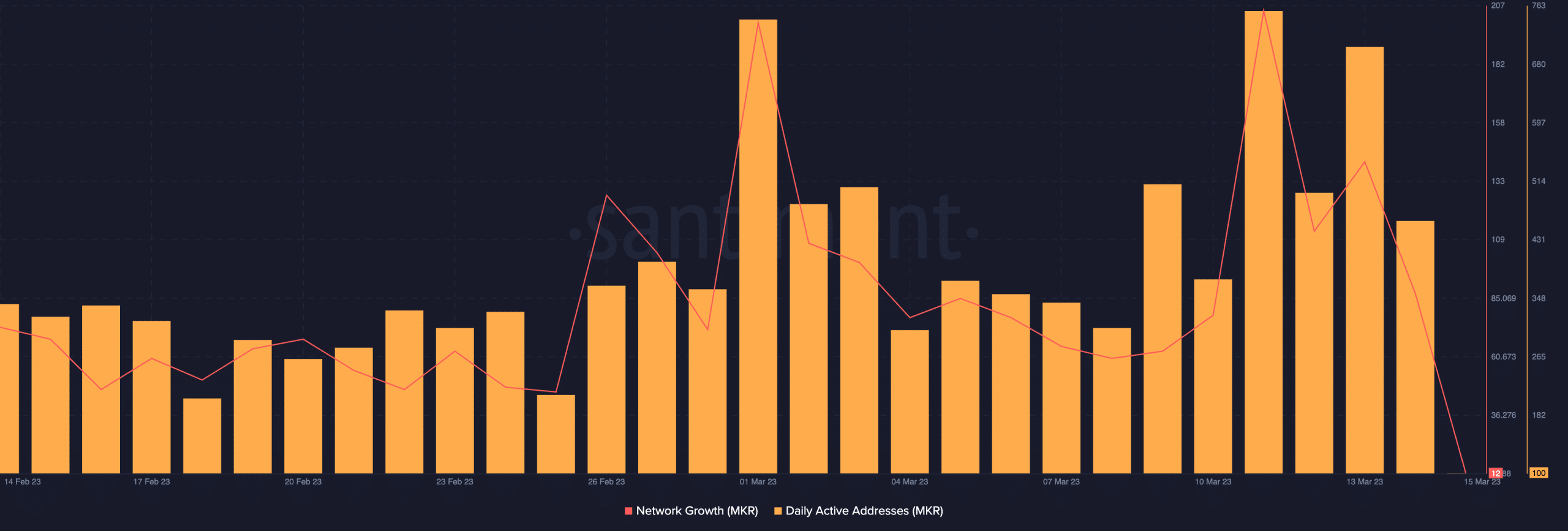

However, the lack of new liquidity caused MKR’s price to decline, and stagnated the uptick. According to data from Santiment, the alt has experienced a decrease in network activity since the beginning of the week. For example, the count of daily active addresses trading MKR has since fallen by 86%. Likewise, new demand that might aid price growth has also dropped by 95% in the last four days.

Source: Santiment

Is your portfolio green? Check out the Maker Profit Calculator

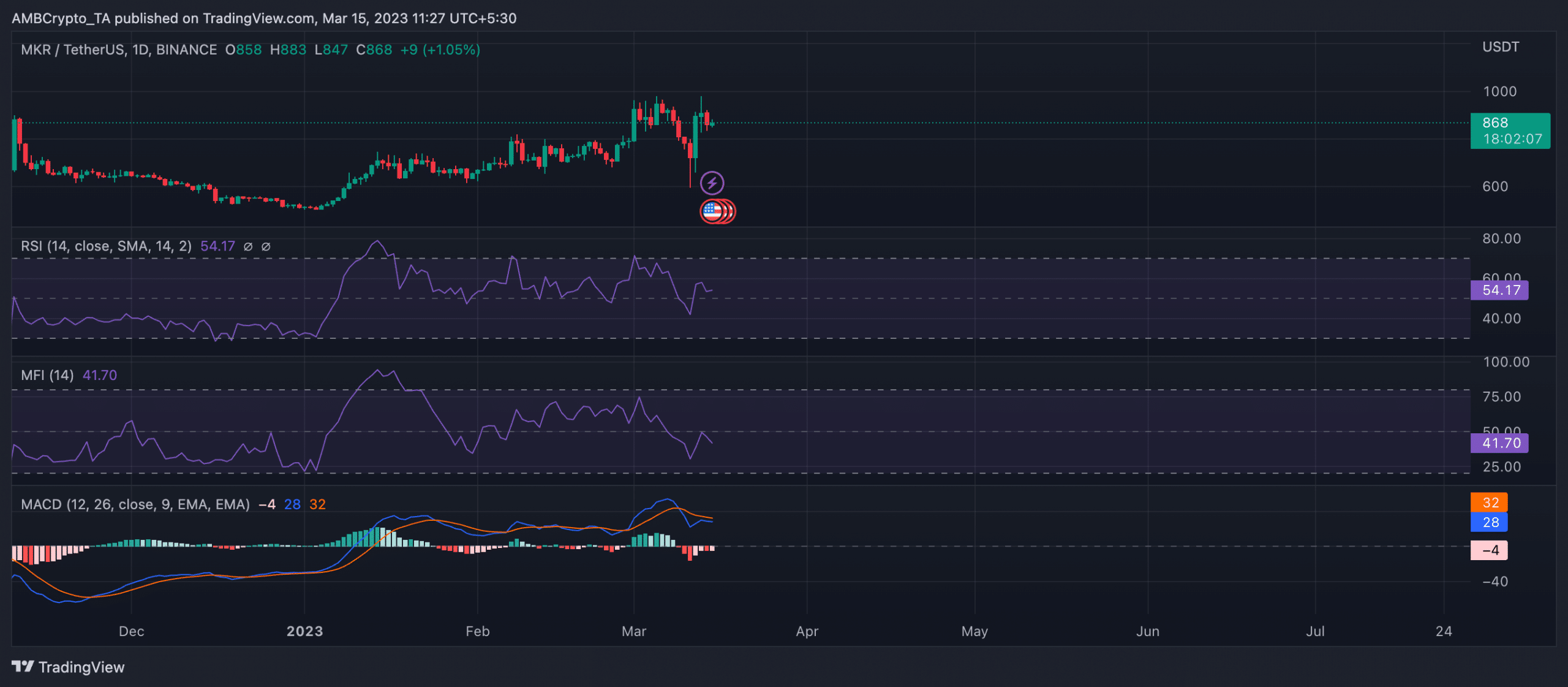

The token accumulation was evident on the daily chart at press time. However, it was not enough to initiate any significant price growth. As of this writing, MKR’s RSI rested above its centerline at 54.17, while its MFI, on an uptrend, was pegged at 41.

A closer look at the asset’s MACD indicator revealed why there had been a price decline since the week started. The MACD line intersected with the trend line on 11 March, ushering in a new bear run, hence the downtrend.

Source: MKR/USDT on TradingView