beginner

Decentralized finance (DeFi) has been changing the world of finance as we know it. But what’s next for this fast-growing industry?

DeFi 1.0 saw the creation of platforms that allowed for peer-to-peer trading, borrowing, and lending with cryptocurrencies used as collateral. However, due to the rapid evolution of blockchain technology and increasing demands from users, DeFi has undergone a major upgrade and formed what we now call DeFi 2.0.

In this comprehensive guide, we take a deep dive into DeFi 2.0 and explore its new features and capabilities that could revolutionize not only financial services but also other industries in the near future. So buckle up, and let’s explore what’s next for decentralized finance together.

DeFi 1.0: Early DeFi Developments

DeFi (decentralized finance) 1.0 refers to early developments of decentralized financial applications and protocols built on top of blockchain networks, such as Bitcoin or Ethereum.

The first iterations of DeFi — projects like MakerDAO — primarily focused on cryptocurrency exchanges and peer-to-peer lending platforms that aimed to provide a decentralized alternative to traditional financial services, enabling users to lend, borrow, trade, and exchange cryptocurrencies without intermediaries. In addition, the first stablecoins were created during this period. These are digital currencies pegged to an asset (e.g., the US dollar), providing stability within a volatile market thanks to the link with its value.

DeFi 1.0 had limitations that slowed down its growth and adoption, but those early developments served as building blocks for further innovation in DeFi technology, leading to the emergence of more advanced and diverse financial instruments within DeFi ecosystems.

What are the limitations of DeFi 1.0?

DeFi 1.0 has been successful in many ways, and it has proven to be a viable alternative to traditional finance. However, it has some limitations that prevent it from reaching its full potential. Here are some of the key limitations of DeFi 1.0.

Centralization Issues

Decentralization is one of the core principles of blockchain technology; it underpins the decentralized finance sector.

However, in the DeFi 1.0 era, many protocols were centralized around a few individuals or entities that controlled the platform’s development and decision-making. For example, the MakerDAO platform, which issues the DAI stablecoin, had a small group of individuals with significant voting power to determine the protocol’s direction. This centralization of power in DeFi 1.0 raises concerns about transparency, censorship resistance, and trust.

Scalability

One of the biggest limitations of DeFi 1.0 is scalability. Many DeFi platforms run on the Ethereum blockchain, which struggles with high gas fees and network congestion during peak usage times. This makes it difficult for DeFi platforms to handle large volumes of transactions and support a growing user base.

Security

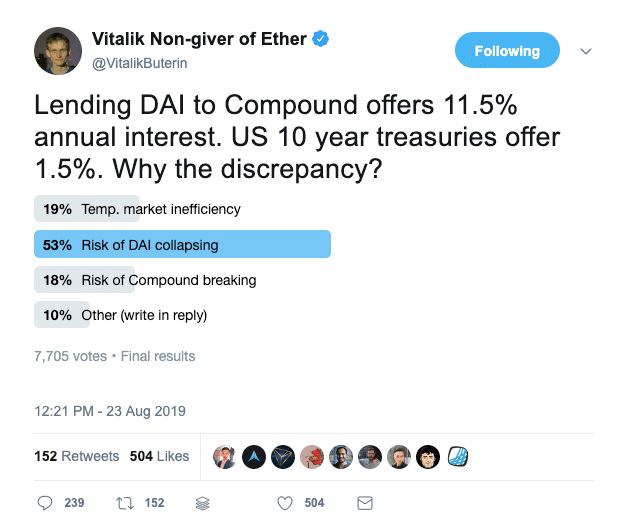

DeFi protocols are built on smart contracts, which are automated computer programs that execute transactions based on predefined rules. While smart contracts are designed to be secure, they are not infallible. Hackers have exploited vulnerabilities in smart contracts to steal millions of dollars worth of crypto assets in the past.

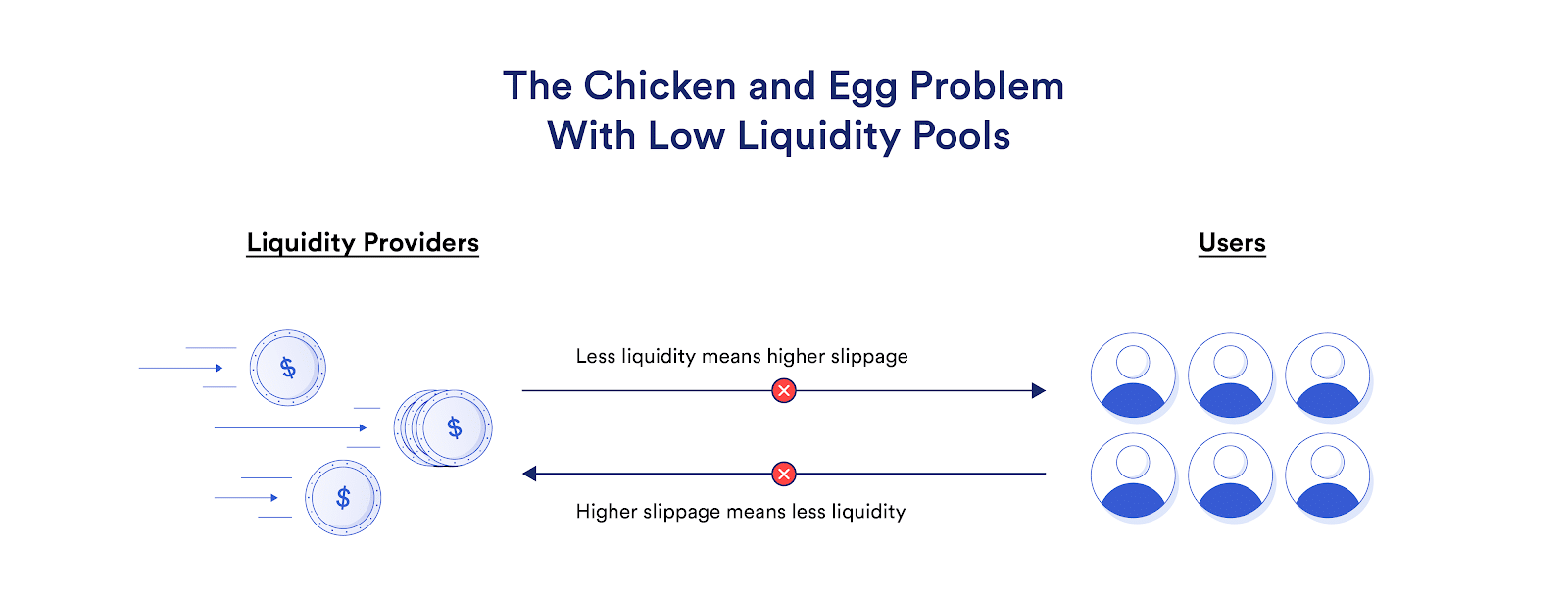

Liquidity

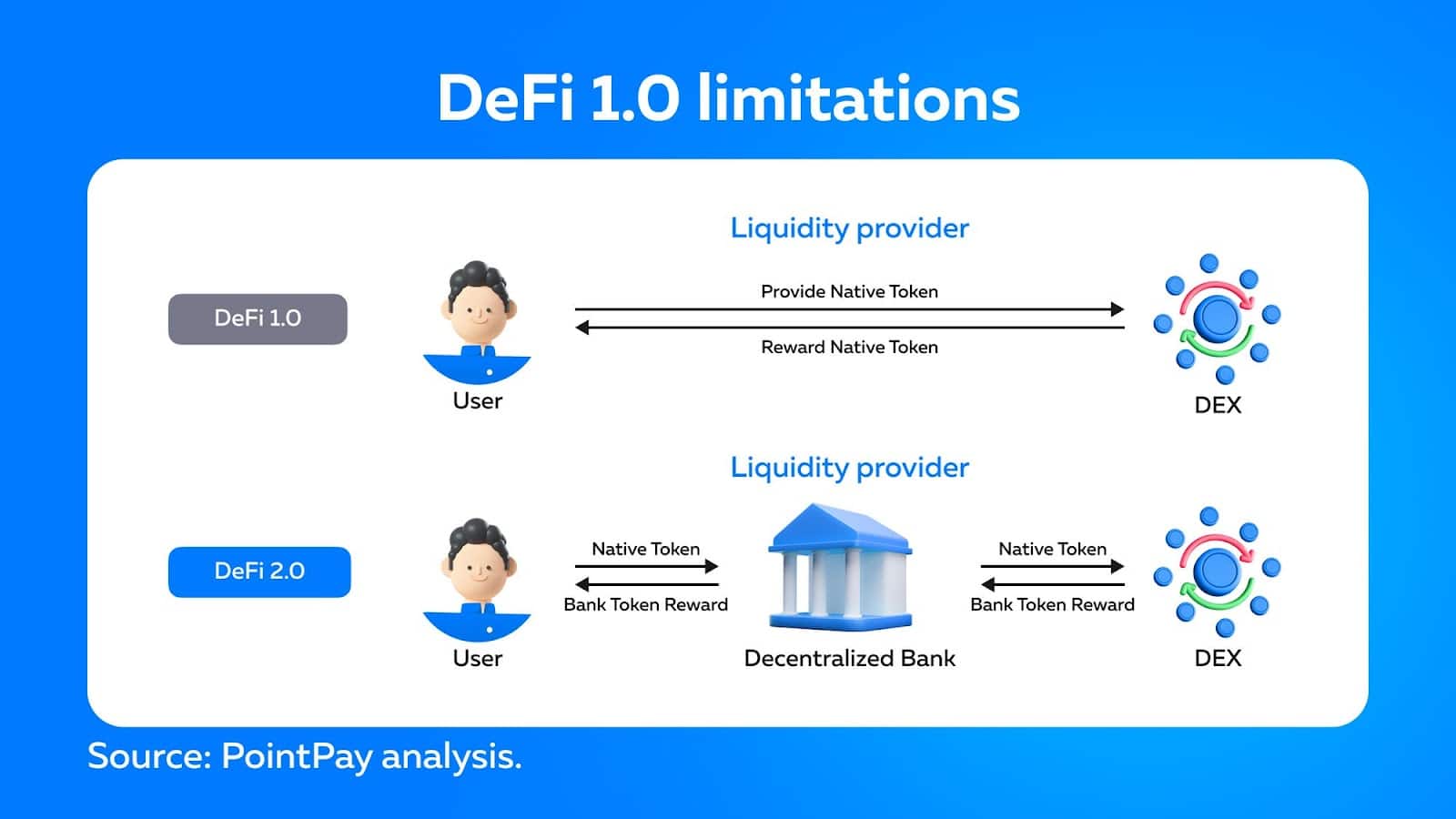

DeFi 1.0 encountered a significant challenge in liquidity, which prevented its widespread adoption. In traditional financial markets, market makers maintain stability by purchasing and selling assets continuously. In contrast, DeFi liquidity is supported by liquidity providers pooling their assets into a liquidity pool for trading purposes.

However, DeFi 1.0 faced several obstacles related to its liquidity providers. One of the most notable difficulties was the fragmentation of liquidity across various protocols, leading to lower individual protocol liquidity. As a result, traders had to perform multiple steps to trade among diverse protocols, making it more complex and expensive to engage in trading activities and leading to capital inefficiency.

Hackers Threat to DeFi 1.0

DeFi 1.0 projects were vulnerable to hacker attacks for several reasons. One of the main reasons is that many previous DeFi services were built on centralized infrastructure, meaning that they relied on a single point of failure. For example, a decentralized exchange (DEX) may have had a smart contract that facilitated trades, but the user interface for interaction with a smart contract may have relied on a centralized server to communicate with the blockchain. If that server were compromised, a thriving DeFi ecosystem would be at risk.

Another reason why DeFi 1.0 projects were at risk of hacker attacks was that many of them were built on Ethereum’s smart contracts. Open-source smart contracts are publicly accessible, which means that anyone can view the code and potentially identify vulnerabilities. While this can be helpful for identifying and fixing issues, it also means that hackers can easily study the code and find ways to exploit it.

Requirement of a Private Key

In DeFi 1.0, one of the main challenges faced by users was the requirement to have a private key to access and manage their assets. Private keys are long strings of characters that serve as unique identifiers and passwords for users’ wallets. This requirement created a barrier for new users who were unfamiliar with the technicalities of managing private keys and could easily lose their funds if they misplaced or forgot their keys.

User Experience

Additionally, DeFi 1.0 platforms typically lacked user-friendly interfaces, which made it even more difficult for users to manage their private keys and navigate complex processes involved in executing transactions. This led to a high degree of centralization, with only a small group of technically proficient users able to participate in DeFi.

Also, the lack of intuitive interfaces can be a barrier to entry for many people unfamiliar with the crypto world.

Ethereum’s Dominance

DeFi 1.0 relied heavily on the Ethereum blockchain, resulting in congestion issues and high gas fees. DeFi 2.0 aims to offer more blockchain options, such as the Binance Smart Chain, to mitigate these issues.

Collateralization

In most DeFi 1.0 lending transactions, the requirement was that the collateral value had to be equal to or greater than the loan amount, making it difficult for many people to qualify for DeFi loans. As a result, this restricted the number of people who could apply for a DeFi loan and also limited the number of individuals willing to accept one.

Transition from DeFi to DeFi 2.0

Unsurprisingly, all these shortcomings led to the search for new solutions in the DeFi space. DeFi 2.0 is the next generation of projects that seek to overcome the limitations of DeFi 1.0 by introducing new protocols and solutions. DeFi 2.0 intends to provide a more reliable, secure, and efficient financial ecosystem that enables broader adoption. Let’s take a look at what this new vision has to offer.

What Is DeFi 2.0?

DeFi 2.0 is the next evolution of decentralized finance, building on the foundation established by DeFi 1.0. While DeFi 1.0 primarily focused on creating decentralized financial products and services, DeFi 2.0 centers on improving scalability, security, and user experience to create a more mature and sustainable ecosystem.

Who’s in control of DeFi 2.0?

DeFi 2.0 aims to build decentralized ecosystems where no single entity is in control. Instead, liquidity providers and token holders have control over the DeFi platforms they use.

The goal of DeFi 2.0 is to create a more decentralized and transparent financial system that provides financial freedom to everyone. DAOs play a significant role in achieving this goal by giving the community more control over the protocol’s development and management, thus reducing the centralization risk.

Some DeFi 2.0 projects, such as Compound, Aave, and Uniswap, have already implemented DAOs as part of their governance models. The governance tokens issued by these protocols allow holders to vote on changes to the platform, such as interest rates, liquidity pools, and even protocol upgrades.

Examples of DeFi 2.0 Protocols

Some of the popular DeFi 2.0 protocols include Curve Finance, Olympus Treasury, ChainLink, and Superfluid. We’ll take a closer look at promising decentralized finance protocols a little later.

DeFi 1.0 vs DeFi 2.0

Decentralized finance (DeFi) has come a long way since its inception, and we are now in the DeFi 2.0 era. While DeFi 1.0 focused on creating a basic infrastructure for decentralized financial services, DeFi 2.0 is about enhancing existing protocols and platforms to ensure its users get more sophisticated financial products and services. Some of these solutions include protocol-controlled liquidity, self-repaying loans, and yield farming.

DeFi 2.0 projects are built on top of DeFi 1.0 and offer a more seamless and efficient user experience. The focus is on creating a thriving DeFi ecosystem that is accessible to everyone and can compete with traditional financial services.

Protection from Financial Losses

Impermanent loss insurance is a new feature offered by some DeFi 2.0 protocols. It seeks to address the issue of impermanent loss that liquidity providers face. Impermanent loss occurs when a liquidity provider’s investment in a liquidity pool loses value compared to tokens held outside the pool. This happens because the price of the tokens in the pool changes relative to the price outside the pool.

Some DeFi 2.0 protocols offer insurance products that compensate DeFi users for any losses they may experience due to impermanent loss. Essentially, these insurance products act as a safety net for liquidity providers, allowing them to take on more risk without fear of losing their investment.

By providing impermanent loss insurance, DeFi 2.0 protocols reduce the risks associated with providing liquidity, which could attract more liquidity providers to their platforms. This, in turn, could increase the liquidity and trading volume of the platform, making it more attractive to traders and investors.

A Greater Value from Staked Funds

DeFi 2.0 protocols aim to offer users a greater value from staked assets by introducing innovative solutions, such as yield farming. Platforms with a novel approach also expand yield farming’s incentives and utility by allowing yield farm LP tokens to be used as collateral for loans. These alternate techniques of liquidity mining are still in their early stages, but they represent a step in the right direction.

Self-Repaying Loans

Self-repaying loans are an innovative concept in DeFi 2.0. They allow borrowers to take out loans eliminating the need for manual repayments. In these types of loans, collateral is provided by the borrower and held in a smart contract. The smart contract then automatically repays the loan by selling some of the collateral as needed in order to cover the outstanding balance plus any interest accrued. This results in a system that is more trustworthy and efficient than traditional lending systems as it removes the need for paperwork, intermediaries, and credit check processes. Moreover, self-repaying loans enable more seamless and dynamic use cases by removing human intervention in the repayment process.

How to Invest in DeFi 2.0 Projects?

Investing in DeFi 2.0 involves various strategies, including:

- Yield farming

- Lending

- Liquidity mining

- Staking

- DEX trading

Yield farming involves earning rewards for providing liquidity to the liquidity pool for the token pair, while lending involves providing funds to the lending protocol and earning interest. Liquidity mining entails earning rewards for providing liquidity to the DeFi platform, whereas staking involves locking up tokens in a smart contract to earn rewards. DEX trading involves trading cryptocurrencies on a decentralized exchange.

Risks of DeFi 2.0 and How to Prevent Them

DeFi 2.0 has the potential to revolutionize the financial industry by providing decentralized solutions that are more efficient and accessible than traditional finance. However, like any emerging technology, it comes with its own set of risks. Here are some of the risks of DeFi 2.0 and ideas on how to prevent them:

- Smart contract risks: Smart contracts are the backbone of DeFi protocols. They are self-executing contracts with the terms of the agreement between buyers and sellers being directly written into lines of code. The code is stored on a blockchain and executed automatically, which eliminates the need for intermediaries. However, this backbone may have a backdoor: it can be vulnerable to bugs, hacks, or exploits that can result in the loss of funds. While smart contracts are audited on a regular basis, ordinary software upgrades and modifications can frequently lead to outdated and redundant information, even from credible DeFi security companies like CertiK. To prevent smart contract-associated risks, users should only interact with reputable decentralized finance projects and exercise due diligence before investing.

- Regulatory risks: DeFi 2.0 operates in a largely unregulated environment, which leaves investors vulnerable to regulatory changes. Regulatory risks can manifest in the form of government bans, legal actions, or new laws that impact the DeFi ecosystem. To mitigate this risk, investors should stay informed about regulatory changes and invest only the funds they can afford to lose.

- Impermanent loss: Impermanent loss is a risk that arises when an investor provides liquidity to the DeFi platform and the price of the assets changes during that time. It occurs when the investor withdraws their liquidity from the platform, resulting in a loss compared to holding the assets. To prevent the impermanent loss, investors can use strategies such as limit orders, hedging, or providing liquidity to less volatile assets.

- Difficulty in finding and accessing user funds: Decentralized finance operates on the blockchain, which means that users have full control over their funds. However, this also means that if they lose their private keys or wallet addresses, they may lose access to their funds forever. To prevent this, users should take extra precautions to protect their private keys and store them in secure locations.

DeFi 2.0 Projects that Might Take Off in Nearest Future

There are several DeFi 2.0 projects that are worth keeping an eye on in the near future. Here are some of the most promising ones:

Olympus DAO

Olympus DAO is truly a pioneer in the DeFi 2.0 field. Launched in 2021, it is a decentralized finance 2.0 project that aims to provide a stable and sustainable currency, OHM, through its incentivization mechanism. The protocol leverages the concept of staking, where users lock up their OHM tokens in return for daily rewards distributed by the network.

The Graph (GRT)

The Graph is a decentralized indexing protocol that allows developers to access data from multiple blockchain networks. It provides a seamless user experience and allows for the development of sophisticated DeFi products.

Uquid (UQC)

Uquid is a DeFi project building a platform with a range of financial services, including lending, borrowing, and staking.

Synapse (SYN)

Synapse is a decentralized identity and access management platform that lets users securely manage their digital identity and control access to their data.

Rarible (RARI)

Rarible is a decentralized marketplace for buying, selling, and creating unique digital assets. It enables creators to monetize their content and allows collectors to own and trade NFTs.

Tokemak (TOKE)

Tokemak is a liquidity provision protocol that intends to provide more capital-efficient liquidity pools.

Frax Protocol (FXS)

Frax Protocol is a stablecoin protocol that uses a fractional reserve system to maintain the stability of its native token.

Abracadabra (SPELL)

Abracadabra is a yield optimizer that allows users to earn high yields on their cryptocurrency holdings. It uses a unique approach that combines liquidity provision with yield farming and also offers self-repaying loans.

Convex Finance (CVX)

Convex Finance is a yield optimizer that provides liquidity to Curve Finance liquidity pools and focuses on Curve liquidity providers’ interests.

Centrifuge (CFG)

Centrifuge (CFG) is a decentralized finance (DeFi) platform that allows businesses to access liquidity by issuing real-world assets as tokens on the blockchain.

Looking for an exchange to acquire the best DeFi coins? Look no more! Changelly offers a user-friendly and intuitive interface that makes buying cryptocurrencies a straightforward process. Additionally, Changelly supports a wide range of cryptocurrencies, including popular options like Bitcoin, Ethereum, and Litecoin, as well as 400+ other assets. Finally, Changelly is known for its fast transaction times and competitive rates, making it a great option for anyone looking to buy cryptocurrency quickly and at a reasonable cost. Try it yourself now!

Closing Thoughts: What Does the Future of DeFi 2.0 Look Like?

DeFi 2.0 is taking the crypto world by storm, and its future looks bright. As more people become aware of the benefits of DeFi, we can expect to see a thriving DeFi ecosystem that rivals traditional financial services. Besides, DeFi 2.0 projects such as the Olympus Treasury and Curve Finance are exploring innovative solutions (e.g., self-repaying loans and protocol-controlled liquidity) to maintain price stability and allocate resources efficiently. With continued innovation and development, DeFi 2.0 has the potential to revolutionize the financial industry and grant greater access to financial services for people around the world.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.