- 1inch daily volume peaks at historic high concluding an otherwise tumultuous week.

- 1INCH sees a return of bullish demand from whales, curtailing its downside.

The crypto market ensured heavy losses last week but the 1inch network managed to conclude it with a massive win. The DeFi protocol revealed that it secured a new volume record on Sunday (12 March).

Is your portfolio green? Check out the 1inch Profit Calculator

According to the announcement, 1inch’s daily volume peaked just above $4 billion on Saturday. This is the highest daily volume that the network has ever achieved in a single day. The protocol noted that the milestone is a sign of DeFi’s resilience, security, and effectiveness.

Yesterday, amidst the challenging #crypto market, #1inch achieved an impressive new record of $4 billion in volumes over 24 hours. 🔥

💯 This accomplishment demonstrates the resilience, effectiveness, and security of #DeFi, as well as the best swapping https://t.co/l8GKwIDgp7… https://t.co/9EUEcm60Bg pic.twitter.com/NkijtLmJsO

— 1inch Network (@1inch) March 12, 2023

Part of the reason for 1inch’s sentiments about the milestone and what it means for DeFi performance is the stablecoin saga last week.

The previous major stablecoin depeg involving UST resulted in massive contagion and fear. The DeFi world experienced a slowdown in activity after that. The volume surge on 1inch highlights a different and more favorable outcome.

Whales and institutions may have been behind the 1inch volume surge

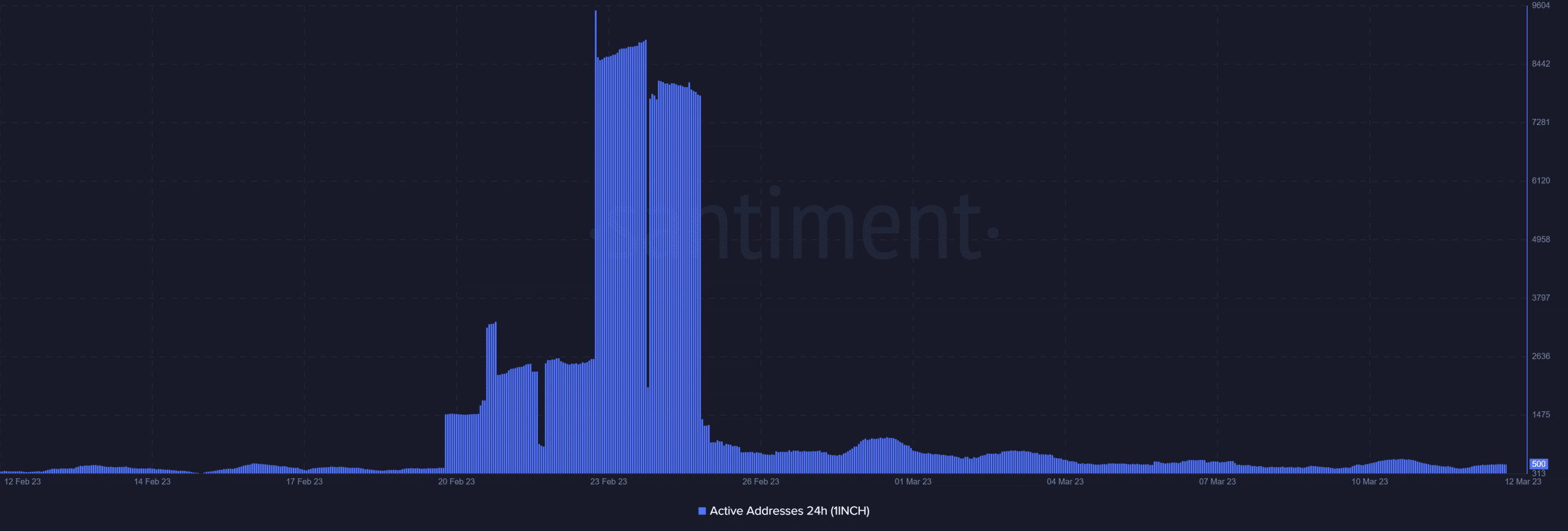

1inch’s 24-hour active addresses metric registered volumes within the normal range between 10 and 11 March. Active addresses peaked just above 600. A far cry from the 9,509 highest number of active addresses achieved in February.

The lack of strong address activity despite the heavy volume suggests a strong presence of whale or institutional activity. Indeed, the supply held by top addresses did increase by a sizable margin despite the market turmoil last week.

Source: Santiment

Furthermore, 1INCH’s MVRV ratio pivoted on 9 March, confirming that there was incoming buying pressure.

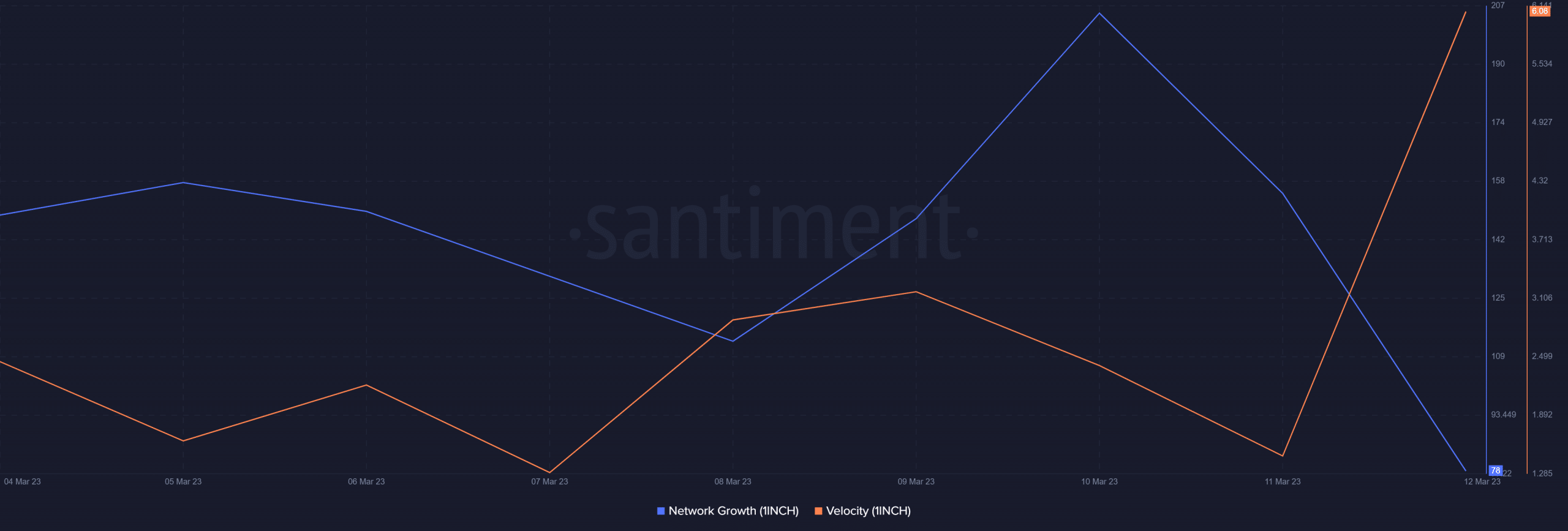

Note that the uptick in the MVRV ratio occurred within the same time as the volume surge was observed. We also saw a resurgence of velocity shortly after, with the velocity metric’s pivot coming in on Saturday.

All the while, 1inch’s network growth pivoted in favor of the downside.

Source: Santiment

One of the likely reasons why network growth tanked despite opposing observations in the other metrics could be low retail activity. Regardless, the whale accumulation was enough to soften 1INCH’s fall and trigger a bit of a pivot.

How much are 1,10,100 1INCHs worth today?

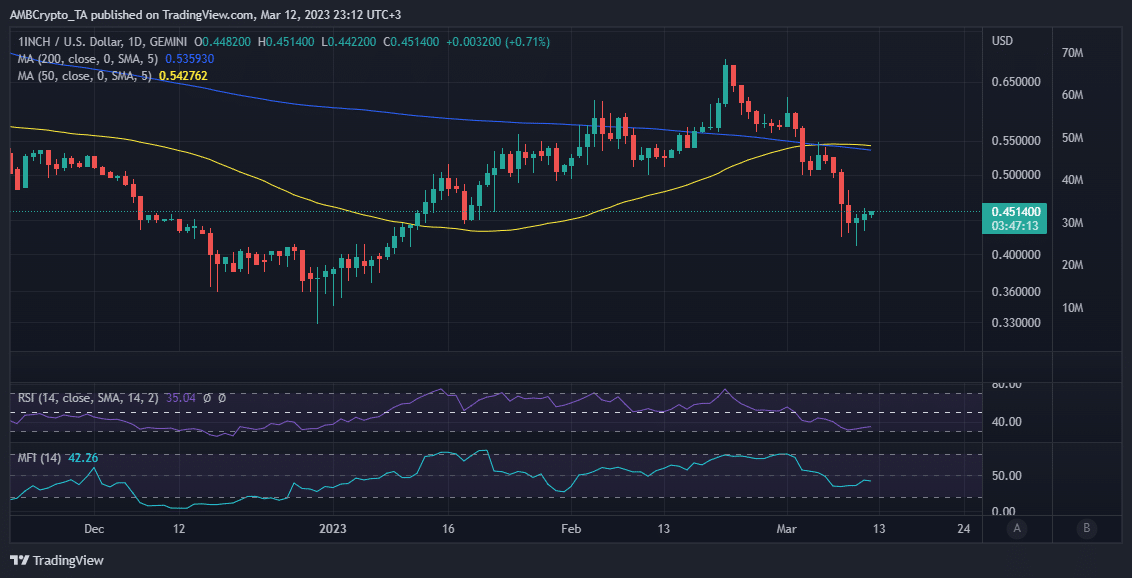

Furthermore, 1INCH bounced off from its month-to-date low of $0.409 on Friday, to a $0.451 press time price courtesy of a 9% rally.

Source: Santiment

Lastly, 1INCH’s price action may experience some more upside if the market continues to rally. On the other hand, the market is still in a fearful mode and it is still unclear whether the worst is over. This may explain the slow return of robust retail demand.