- 1INCH’s DeFi ecosystem witnessed growth to see increased revenue and fees.

- The number of transactions declined, but investors’ confidence went up.

1Inch Network [1INCH] recently achieved a new milestone in its DeFi space. This reflected the network’s increased adoption and usage. 1INCH garnered a total of 1.8 million users on Ethereum.

Not only this, as per Dune, the total number of unique addresses on 1INCH exceeded 2.9 million, with BNB Chain having the highest share of nearly 44%.

Whoa, looks like we’re going to need a bigger boat!

#1inch just hit 1.8 million users on the #Ethereum network.

That’s a lot of #DeFi enthusiasts riding the wave

with us. Let’s keep it going!

Check out our dashboard: https://t.co/iWL4B94GdZ@ethereum #1inchCommunity pic.twitter.com/MpkITl0jxp

— 1inch Network (@1inch) March 3, 2023

How much are 1,10,100 1INCHs worth today?

The visible growth in the DeFi space

Interestingly, with the increase in the number of users, the network’s revenue also went up in the last two days. In fact, the same trend was similar with fees.

Source: Token Terminal

Apart from these metrics, 1INCH has also been making multiple efforts to expand its presence in the DeFi space through new partnerships.

One of the major partnerships was with Burrito wallet, a multi-chain wallet that connects users to DEXes, DeFi platforms, NFT marketplaces, and various dApps, which happened in February.

As per the official announcement, this partnership between 1INCH and Burrito Wallet offers Bithumb users a chance to conveniently find the best token prices across a wider range of DEXes.

Realistic or not, here’s 1INCH market cap in BTC‘s terms

While the aforementioned updates looked optimistic for the network’s DeFi ecosystem, a number of the other metrics did not follow the trend and registered a decline over the last few weeks.

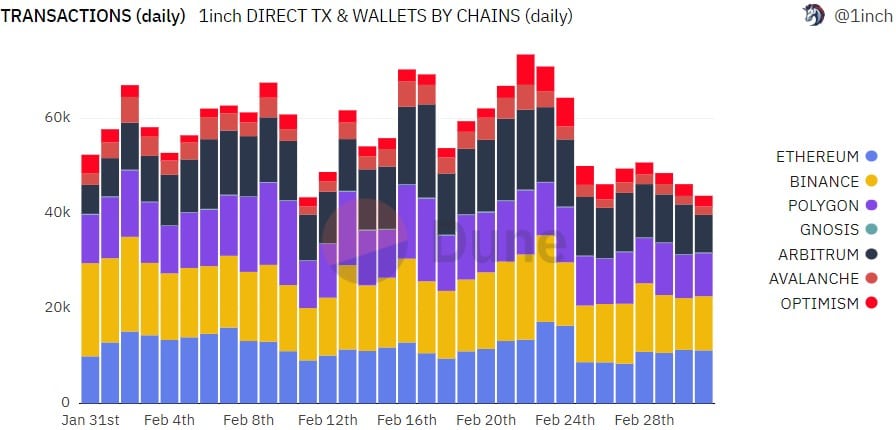

For instance, despite an increase in users, daily transactions on 1INCH declined. The monthly chart also revealed the same situation of a decline.

Source: Dune

In addition to that, the number of daily wallets also took a hit in the last few days, which indicated less activity on the network.

Confidence in 1INCH remains high

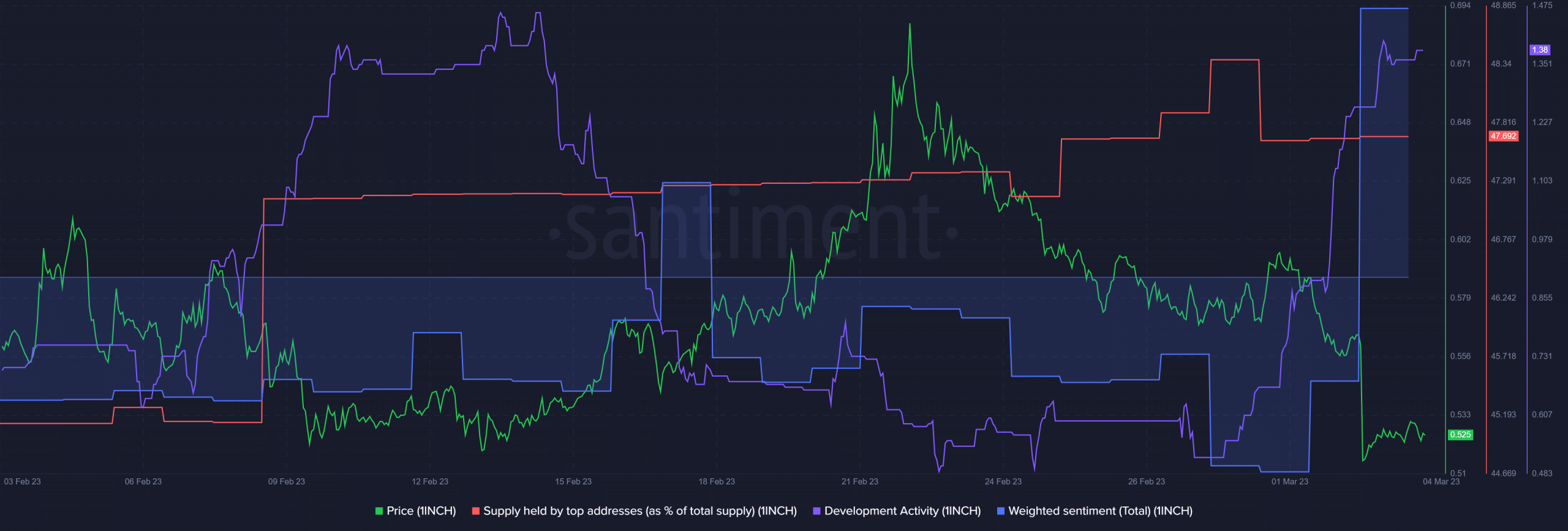

Though activity on the network declined, investors’ confidence in 1INCH seemed to have remained unaffected.

CryptoQuant’s data revealed that 1INCH’s net deposits on exchanges were low compared to the 7-day average. Thus, suggesting less selling pressure.

Whales’ trust in 1INCH increased, which was evident from an increase in 1INCH’s supply held by top addresses over the last month.

In fact, the token’s weighted sentiments have also spiked towards the positive side lately. Furthermore, 1INCH’s development activity increased considerably, which overall looked optimistic for the network.

Source: Santiment